The Privatization of Orderflow and Resurgence of the Fat App Thesis

Fat apps are inevitable

Updated Orderflow data as of Aug 19th:

Over the past 30 days, Ethereum witnessed over $12 billion in order flow volume with two-times the order flow coming from proprietary applications.

The privatization of order flow is only going to grow as the value of blockspace commodities and paves the way for fat applications.

Source: Orderflow.art

But how did we get here? And where are we going?

The short answer for how we got here is, foodcoins. The slightly longer version is that Defi summer catalyzed an abundance of prosumer and retail trading, which subsequently led to the birth of transaction aggregators like 1inch that offered users better price execution through private order routing. Wallets (e.g. MetaMask) quickly followed suit, realizing that they could monetize user convenience by adding in-app swaps, proving that an extremely valuable business model existed for any application that controlled the end user attention (and orders).

Over the past two years, we’ve seen two additional categorical players enter the private order flow landscape – Telegram bots and solver networks. Telegram bots have kept in line with MetaMask’s “convenience fee” offering users an easy way to trade long-tail shitcoins assets from the comfort of their group chats. As of July, Telegram bots account for ~17% of transactions and 6% of trading volume, the majority of it going through private mempools.

Source: Dune

On the other, fat-head side of the market, solver networks (i.e., Cowswap, UniswapX) also emerged as core venues for trading highly liquid pairs in significant size (e.g. stablecoins and ETH/BTC). Solver networks changed the order flow market structure by outsourcing the job of finding the optimal route for a given trade to a competitive market of solvers (market makers).

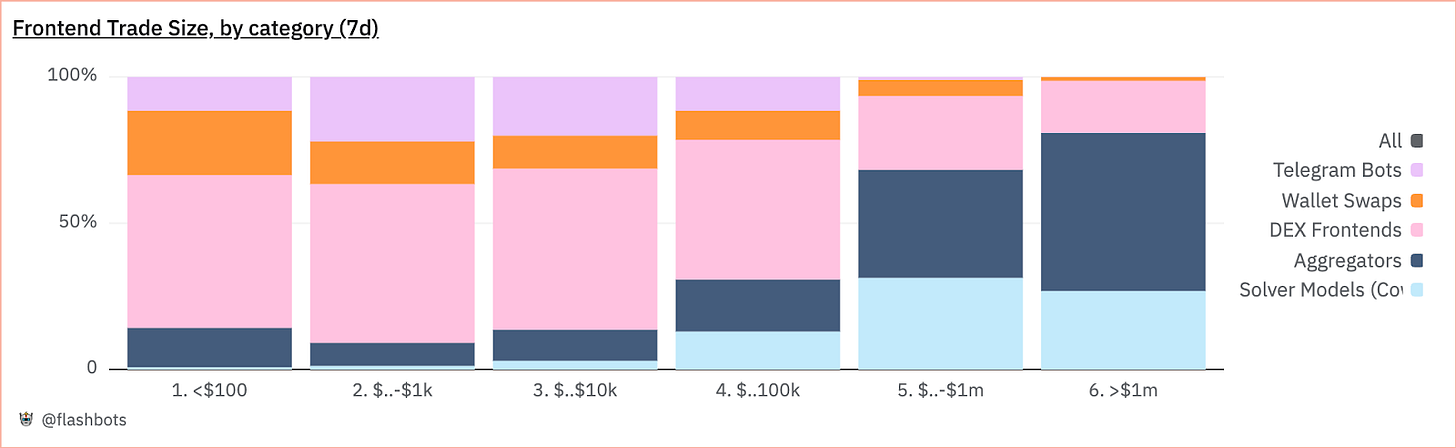

As a result, there’s a budding bifurcation in trading venues, whereby convenient front-ends including, TG Bots, wallets swaps, and Uniswap’s front-end are predominantly used for longer tail, lower value (sub $100k) transactions while aggregators and solver networks are the go-to venue for larger transactions, usually involving stablecoins and majors (ETH/BTC).

Upon more granular filtering you’ll notice that most of the private orderflow comes from aggregators (e.g. 1inch) and front-ends (TG bots, wallets, and front-ends).

The privatization of order flow is even more pronounced when we consider that, on transactions basis, only 30% of Ethereum transactions go through private mempools, meaning that the minority of transactions contribute to a significant percentage of private order flow volume.

Put another way, valuable order flow is more important than order flow quantity. The power law of users and order flow leads to an inevitable conclusion – applications will accrue the greatest proportion of overall value. Said another way, the fat app thesis is alive and well.

Towards Fat Apps

Uniswap’s protocol is clearly valuable, but the more interesting story is happening at the application layer as Uniswap has made efforts to become a consumer application – verticalizing key components of their stack – from expanding the capabilities of their interface, mobile wallet, and aggregation layer. For instance, Uniswap Labs’s applications – Uniswap’s front-end, wallet, and aggregator UniswapX – originate ~16% of the $8 billion in private order flow volume over the last 30 days and nearly ~18% of total order flow (private and public).

Elsewhere in the crypto landscape, apps like Worldcoin account for nearly 50% of Optimism mainnet activity which has pushed them towards launching their own appchain, further highlighting the fat app thesis and the power of controlling demand (e.g. users and transactions).

Even top NFT projects like Pudgy Penguins that possess strong brands are building their own chains, with Luca, the CEO and cheif Pengu explaining, that controlling the blockspace upon which your distribution is built is advantageous for value accrual to the Pudgy brand and IP.

Looking forward, apps should look towards creating new types of order flow whether through the creation of new assets (e.g. Pump and memecoins), by building applications that create new user utility such as identity (i.e.. Worldcoin, ENS), or by crafting better consumer experiences that are vertically integrated and support valuable transactions such as Farcaster and frames, Solana Blinks, Telegram and TG apps, or onchain games.

Final Thoughts on Fat Apps

It’s worth noting that the fat app thesis has been top of mind for many in crypto since the end of the last cycle once the appchain thesis cemented as part of the consensus viewpoint.

My current view on how the Fat App Thesis plays out is that we’ll see the majority of value accrue to the application layer of the stack, where the control of users and orderflow keeps apps in a privileged position. These applications will likely be coupled to onchain protocols and primitives, similar to those of today including UniswapX and Uniswap Protocol, Warpcast and Farcaster, Worldcoin and Worldchain. Ultimately, these protocols, especially those maximally onchain (e.g. MakerDAO) can still accrue significant value, but the apps will likely capture more value given their proximity to the users and offchain components that give apps more defensible moats.

Finally, I still believe that there’s still a path for Layer 1 blockchains (e.g. Bitcoin, Ethereum, Solana) to capture significant value as non-sovereign reserve assets where the underlying assets (e.g. ETH) accrue immense value. It’s possible that given enough time, apps will try to build their own L1s just as they’ve built their own L2s, but spinning up commodity L2 blockspace is very different than bootstraping an L1 and transforming a governance token into a commodity and collateral asset, so that’s probably a debate for a distant future.

The core takeaway is that as more applications create and own valuable order flow, the crypto world will re-rate applications as people come to the inevitable conclusion – fat apps are inevitable.

Great article. I wonder if we'll see app teams building their own in-house order routing infra in a similar way to how Southwest Airlines trades oil futures to lock in prices for better customer experiences.