Verticalization of the Web3 Social Stack

Examining the exchange-first vs social-first approach to building web3 social apps

As usage of crypto social platforms and financial games increases, the way they are constructed will continue to evolve. We can expect to see a trend towards increasing verticalization, with projects seeking to offer a more seamless and comprehensive experience for users that enables the creation of new consumer behaviors and attention or social-based assets. While not all web3 social experiences are financial, the blockchain rails that underpin crypto consumer applications allows for new token-incentivized behaviors and digitally native assets to be imbued into the social experience.

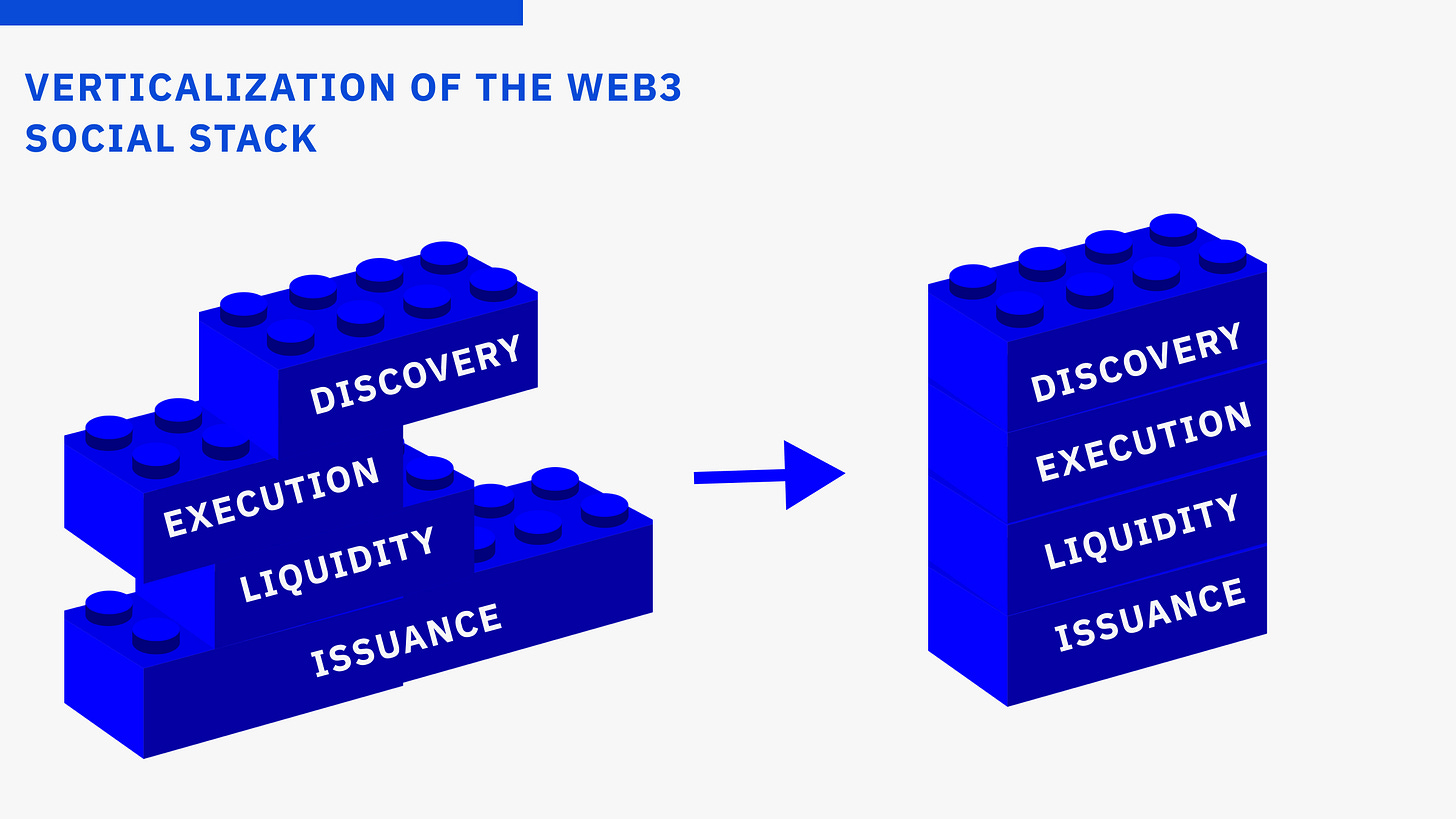

The existing SocialFi stack is comprised of four core layers:

Discovery - where people discover what to buy

Execution - where assets are bought and sold

Liquidity - where assets reside and are pooled

Asset issuance - where assets are created

Today, the stack is fairly fragmented, with the user discovery and social experience decoupled from execution (e.g. trading), liquidity, and asset issuance. But as the SocialFi frontier expands, applications will continue to verticalize attention and markets in an effort to control user social experiences and attention asset liquidity.

SocialFi app builders will need to own multiple layers of the SocialFi stack in order to build protocol defensibility. Attention asset trading (e.g. execution) and issuance are commoditized layers of the stack – token issuance is increasingly easy, and execution can be added anywhere that owns eyeballs. Owning either the discovery or liquidity layer will be of increasing importance, since these are defensible layers of the SocialFi stack that exhibit strong network effects.

Within SocialFi, most applications are choosing between two approaches towards verticalization:

Exchange-first approach: Build an exchange or marketplace where users trade attention assets (e.g. Robinhood for memes) and evolve into a social/discovery platform from there

Social/discovery-first approach: Build a social platform to own discovery and then layer in financial elements and primitives with consumers/attention merchants as a key stakeholder in the platform

Exchange-First

Any social network or discovery platform faces significant headwinds: bootstrapping new social graphs, spurring new consumer behaviors, and retaining user engagement in an era of a hyper-competitive attention market. Given these obstacles, the exchange-first approach is arguably easier to jumpstart, because users’ appetite for speculation helps to surmount those headwinds. However, this approach faces more competition because of the ease with which exchanges can be bootstrapped compared to social networks and the benefits that social networks retain once a threshold density has been reached.

From the exchange-first approach, deep verticalization of the SocialFi stack has proven effective because exchange-first applications have attention-trading capabilities built in. For instance, Friendtech has emerged as one of the most vertically integrated SocialFi apps, with control over the entire stack. The app serves as the focal point for key discovery, exclusive execution, and leverages a native financial primitive––a bonding curve––that issues assets with utility specific to the Friendtech app.

Newer SocialFi protocols have also vertically integrated the SocialFi stack. For example, memecoin issuance and discovery platforms like Pump and Ape Store, allow users to easily deploy a memecoin on a bonding curve. This enables users to easily purchase tokens directly from the bonding curve, as opposed to having to wait for someone to seed liquidity into a DEX or liquidity pool. While some Pump initialized memecoin execution and discovery can occur on other platforms—Dexcreener and Twitter, respectively— protocols like Pump still provides a unique social discovery experience and execution platform for its newly launched tokens.

Discovery-First

Historically, the discovery-first SocialFi approach has seen success through the likes of Twitter, Farcaster, and Telegram, and also through market terminals like Dexscreener and Coingecko. Many of these applications have tried to move down the stack to offer execution (e.g. trading) of tokens, but have yet to fully lean into offering custom, proprietary trading experiences.

The exception is Telegram, which has successfully integrated the social-financial experience. Still, Telegram’s UX is limited, and while degens have opted for it for convenience, there is room in the market for more Robinhood-esque experiences that offer seamless trading UX, easy onboarding, and retail friendly features like commission-free trading. Moreover, new primitives like Farcaster frames and casts and Lens open actions further enable new types of financial transactions within these discovery-first networks.

Final Thoughts: Be Opinionated

Builders can create compelling social-financial games and networks by taking a unique approach to how app monetization and financialization impact their apps. The exchange-first approach is easier since it doesn’t necessarily rely on creating new consumer behaviors, people already want to trade attention. But, a discovery-first approach where a platform controls eyes is historically more defensible than one that only controls orders (e.g. transactions). The primary goal of the discovery or social-first approach is to iterate quickly, testing new consumer behaviors and social-financial dynamics until users showcase their revealed preferences that have the potential to grow into large social networks. I’m confident that the most successful apps will have opinionated, vertically-integrated designs that create liquid marketplaces for new types of assets or that otherwise catalyze new consumer behaviors.

Great article! Pump is full stack tho.

Is Polymarket another example of successful verticalization like Friend.tech? Oh and I noticed that your definition of SocialFi is pretty wide, it seems that any applications that has elements of any part of the stack can be considered partly SocialFi? I do not disagree though, just another perspective which I had never thought off, its pretty cool!

What about Fantasy.top? That's an example of an "Exchange-First" approach right, with Twitter and partly their own marketplace serving as the discovery channel.

Thanks for the great read! Really enjoyed all of the writings done on SocialFi by you and Variant Fund, you guys have a great understanding of this niche within crypto, really helped me a ton in my research.