The New Attention Merchants: Expanding the SocialFi Frontier

Tim Wu

The internet is a marketplace for attention, and the competition for attention is growing exponentially. Crypto represents a new chapter in the story of the attention economy, offering mechanisms to more efficiently value attention through ownable attention assets across content, social graphs, memes, algorithms, and platform social activity.

But crypto doesn’t only change how attention is valued—it also promises to change who the value of attention accrues to.

In 2016, Tim Wu introduced the term “attention merchants” to refer to the way publishers and, later, platforms have exploited users’ attention for profit. Crypto creates a pathway for users to become their own attention merchants, recapturing the value of our attention through ownership of attention assets.

The most notable instance of this trend is within SocialFi, where users are able to own the flow of attention to assets such as memecoins, influencer access keys, content, etc. By creating pathways for users to directly engage with attention-based assets, SocialFi platforms challenge the traditional power dynamics of the attention economy, turning users from passive consumers to active participants—the new attention merchants.

The SocialFi Frontier

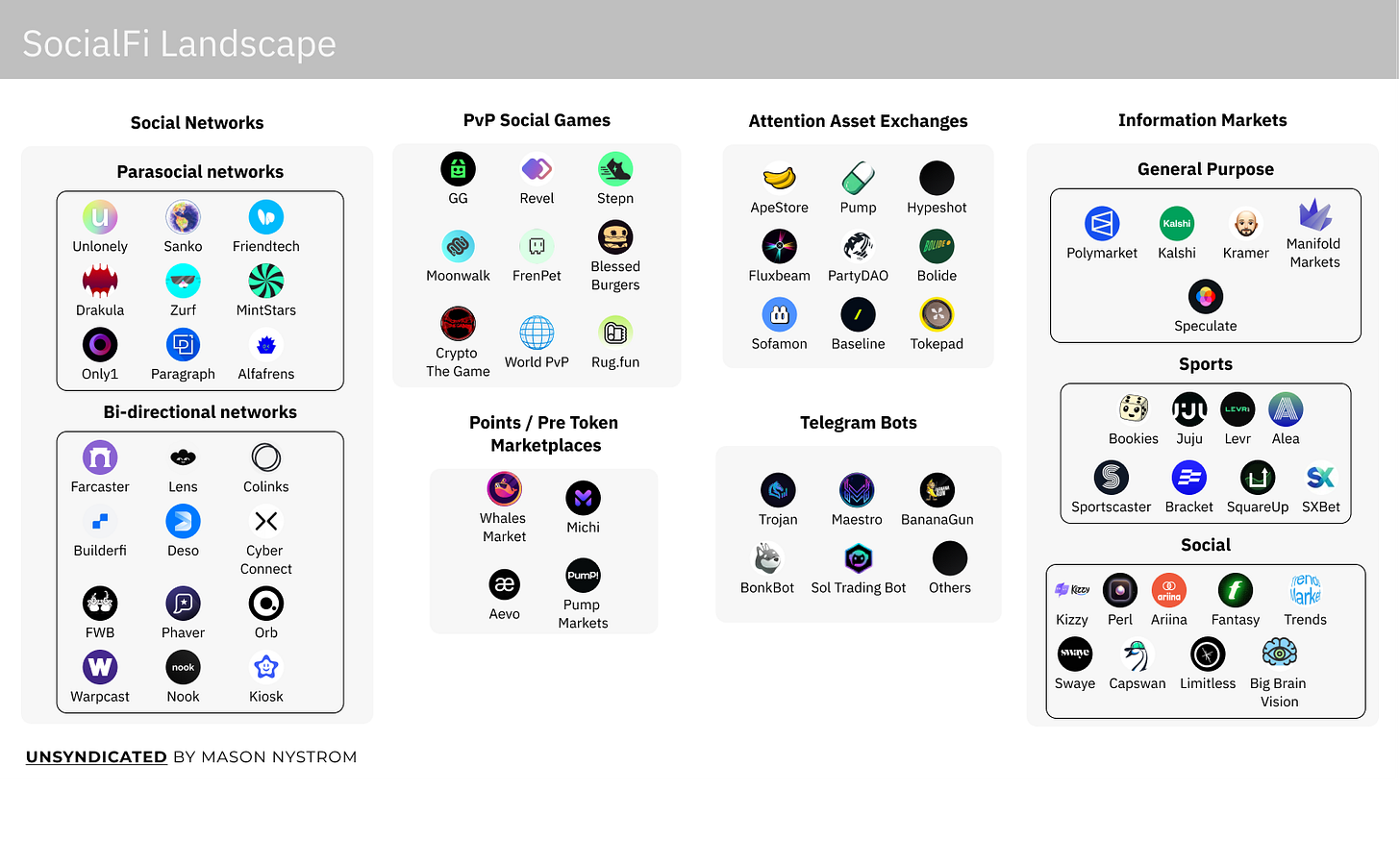

SocialFi is shaping up to be a defining category within web3. Crypto social networks like Farcaster are gaining steam, with over 75k DAUs. Telegram bots, which couple group messaging and trading, facilitate billions in trading volume. And information markets are now moving toward financializing social graphs such as Twitter (i.e., Trends.market, Fantasy.top) and Farcaster (i.e., Swaye, Perl, Arrina).

While not all social platforms will have financial incentives attached, SocialFi represents one evolution of social from indirectly valuing social capital to t more efficiently valuing social- and attention-based assets. As a socio-economic technology, crypto enables social applications to add other financialized elements (e.g. asset trading) or natively integrate financial primitives into the application layer (e.g. Friendtech bonding curves). The SocialFi trend is being driven by consumer desire to own and trade in attention assets. Users are choosing to spend time in applications that allow them to earn based on their attention, or play financial games to enhance the social-entertainment experience.

For instance, there’s Fantasy, a fantasy sports trading card game and information market built atop X’s (formerly Twitter) social graph. Fantasy allows creators to earn money from their social media presence, while enabling players to earn rewards based on their intuition and knowledge of certain social accounts. Elsewhere, new social networks like Friendtech, Unlonley, and Sanko allow creators to directly monetize their social interactions through chat access passes. This benefits users who purchase access passes early, rewarding them for allocating their attention to undervalued creators and groups.

The core benefit across both new information markets and social networks is that creators and users are now the attention merchants, owning the attention assets within these applications and monetizing the attention through app usage.

Many applications have responded to the user desire to embed commerce and finance inside within their social experiences:

Messaging → in-message transactions and trading

Gaming → ownable assets and in-game economies based on real-moneyTM

Social → ownable social graphs, channels, content, and platforms

Memes → scenecoins and derivative memetic assets

Information markets → new markets for social-based entertainment, influencers, and social capital

Exchanges → new protocols for issuing social- and attention-based assets

Over the past year, the SocialFi ecosystem has grown rapidly, with an explosion of companies across attention asset exchanges (e.g. memecoin protocols), PvP (player vs player) social games, new forms of information markets, and financialized social networks. The driver behind this expansion is the maturation of crypto infrastructure across two vectors, scalability and usability, which has supported new types of consumer experiences (e.g. mobile PWAs), cheaper transactions (e.g. L2s), and faster app iteration cycles through improved developer tooling (i.e., account abstraction and wallet as a service tooling).

Social Networks

Social networks can broadly be categorized into two subgroups with their respective creator monetization models: parasocial and bi-directional.

Parasocial networks are platforms where creators and fans have a one-sided relationship. The one-sided relationship is often paired with a direct monetization model such as subscriptions (i.e., Substack, OnlyFans, Patreon) or through a direct ad revenue cut to the creators (i.e.,YouTube, TikTok).

On the other side of the spectrum are bi-directional networks where creators and fans have a dual-sided relationship (i.e., Twitter, Reddit, Facebook, Snapchat). Bi-directional social networks allow users to monetize distribution that encourage reach rather than restrict it, as is the case with token-gated access (e.g. influencer gated chats). Web2 bi-directional networks like Twitter and Linkedin have historically made it more challenging for creators to directly monetize their reach. Instead, creators have had to for strategies such as affiliate programs, directing users to other monetization sites (e.g. Twitter → Substack), or promotional campaigns.

By re-imagining users as the new attention merchants, SocialFi offers a variety of new monetization options for both categories of social networks. Parasocial networks offer creators the ability to further monetize the top percentiles of their audience through tokenizing content, influencer access, ephemeral perks (e.g. time-limited rewards), or social status. Parasocial networks Drakula and Friendtech have tokenized content and creators, respectively, enabling the top creators to earn revenues from trading volumes. Sofamon showcases one example of a token model where individuals can slowly purchase an aesthetic good (e.g. avatar clothing) until they own a whole item, which is then wearable.

Web3 social networks offer new options for monetization. One example is username and namespace monetization, which can generate revenues for valuable namespaces that scale to millions of users. Elsewhere, bi-directional social networks can make better use of in-app transactions. This can manifest as in-social network marketplaces, channel storefronts, or in-app games.

The key difference with web3 bi-direcitonal networks versus web2 social networks is that the new attention merchants—users and creators—will be able to better earn from their activity. For instance, imagine if Reddit subreddits moderators could own their channels, earn revenue based on ads they showcased, or earn a piece on transactions that go through their channels because of the communities that they curate.

PvP Social Games

As consumer infrastructure has matured, it has unlocked a new frontier of PvP (player vs player) social games. Most notably, a wave of Survivor-esque competitions—including Crypto The Game, Blessed Burgers, among others—have emerged that offer new digitally native and highly social game experiences for users to earn valuable prize pools. Other applications, like Rug.fun or PvPWorld, provide game theory strategy games where users can coordinate with others in order to win prizes. Contrast this with web2, where most mobile games monetize attention through traditional advertising, or offer users a way to pay to play the game (e.g. users don’t have to wait for cool down periods). Game developers now have new business models where social games resemble content, with developers releasing multiple ephemeral applications that offer shortened play cycles where users can earn significant rewards from participation before moving onto the next game.

New types of social games should optimize for: multiple winners, which enables greater participation; easy-to-play games, where average users feel like they have high perceived odds of winning; and social interactions, which further enhance the virality of these games. These proposed game dynamics are more incentive aligned than web3 games, which have historically bent towards pay-to-win type games or farm-first vs fun-first games.

New Marketplaces and Exchanges

Crypto dominant use cases revolve market creation, specifically the issuance of new asset classes, bringing existing assets onchain, or expanding access to digitally native assets.

Information markets – Information markets like Polymarket have the potential to create more efficient political markets and support the creation of new types of event markets based on real world events, culture, and business.

Attention exchanges – Launchpads like Pump and Ape.store let users create new assets (e.g. memecoins) based on one quality:attention. Elsewhere, Sofaman is tokenizing status and culture by enabling users to create a telegram-based digital avatar that has branded clothing for sale on a bonding curve.

Telegram bots – Telegram bots bring marketplaces and social-financial games into the messaging experience and offer a more convenient experience for users

Points and pre-tokens – Points have been an effective incentive strategy for teams to test user behaviors and experiment with dynamic incentives. Points marketplaces like Michi and WhalesMarket and pre-token marketplaces like Aevo can help create more efficient markets for tokens.

Several sub-trends are spurring the creation of new marketplaces and exchanges. First, an increase in the verticalization of social and financial platforms is driving these apps to issue new types of assets. Second, growing user ownership around onchain activity through earning points, tipping, and tokens is increasing the surface area of assets for users to interact with, encouraging the creation of new trading venues. And finally, users are now interacting with assets, such as memecoins, where they feel a greater sense of perceived autonomy. Similar to real world cultural assets such as sneakers or music, users feel a sense of perceived control over the popularity and potential appreciation of these cultural based assets, since the fundamental metric that gives the assets value (a users’ attention) is controlled by the end consumer.

Building for the New Attention Merchants

There’s a paradigm shift happening in social, where the dynamic between users, creators, and attention is being redefined. At the heart ofthese trends is the transition from users and creators as the supply and demand side of the attention economy to being able to become the merchants of their own attention.

It’s admittedly hard to design new financial or social primitives, let alone primitives that blend the best of both into a unified experience. The early social-financial tools, toys, and games that become the next era of SocialFi networks and applications will be those that speedrun experimentation, testing new consumer behaviors and capitalize on the emergent behaviors and revealed preferences of consumers.

Thank you for this analysis and research.

Question for you:

Do you think that eventually, everyone's digital life becomes monetizable by that specific individual? More so than just influencers and creators too, even Aunt Sally whose data has some value to advertisers. In a sense, that's what's happening now but the value accrues to the social media company. Seems that the ad revenue of social companies should be the income of the influencer.

Thoughts in relationship to SocialFi and what you're seeing on the frontier?

Mason, you're literally the smartest guy in crypto, imho. Everyone knows the BAT team is aggressively sitting on 25m DAU of the Brave browser (privacy, wallet, "advertising"). $375m market cap.

"the medium is the message".

The token is easily the top acquisition target for any crypto "institution" that can do the math and is a tad braver...

The key infra is still "in" the browser, locally downloaded, has access to any reputation/accountability/review manifest3 to de-platfrom, de-centralize, and even aggregate...

"presponse" to your spot-on article:

https://www.reddit.com/r/BATProject/comments/rxgyse/comment/hridf03/