Welcome to the Corona Recession

How Coronavirus will impact the next decade.

Welcome to the Recession, everyone. I hope that you’ve been practicing social distancing and remaining safe, especially if you’re in a high-risk category.

Welcome to the Recession, we've got a dangerous game

Costco’s got everything you want, but it’s called Kirkland by name

We are the people that can find whatever you may need

If you got the money, we’ve got your diseaseRecession, welcome to the Recession

Watch it bring you to your shun n-n-n-n-n-n-n-n knees, kneesWelcome to the Recession Remix - Germs & Roses

Consumer spending accounts for approximately 70% of the U.S. economy each year. Even a small decrease “technically” accounts for a global recession and a major drawdown will equate to a more significant recession.

For those who haven’t been following the #CancelEverything trend on Twitter, here’s a quick synopsis of the resulting cancellations:

NBA and NHL regular season is postponed

Premier League postponed

Nearly all public and private schools and universities closed

Most companies have transitioned o remote work

Travel to and from specific regions has been banned or limited

Lousiana primary and other election primaries have been delayed

Disneyland and Broadway are closed

Most gatherings of over 250-500 people have been canceled

All major business conferences (SwSx) have been canceled or shifted to virtual conferences

Temp jobs, retail, small businesses, airlines, and more are drastically impacted

insert your favorite hobby, event, or outdoor activity

The Coronavirus will impact the world several times over by the time it is finally finished. I don’t just mean right now or for the next sixth months, but for the years (and potentially decades) that come after. Why am I so confident that this pandemic will have a lasting effect?

Long Tails Drive Everything

It’s simple, long tail events shape the world. They don’t just shape the world once but result in a rippling effect that influences future events.

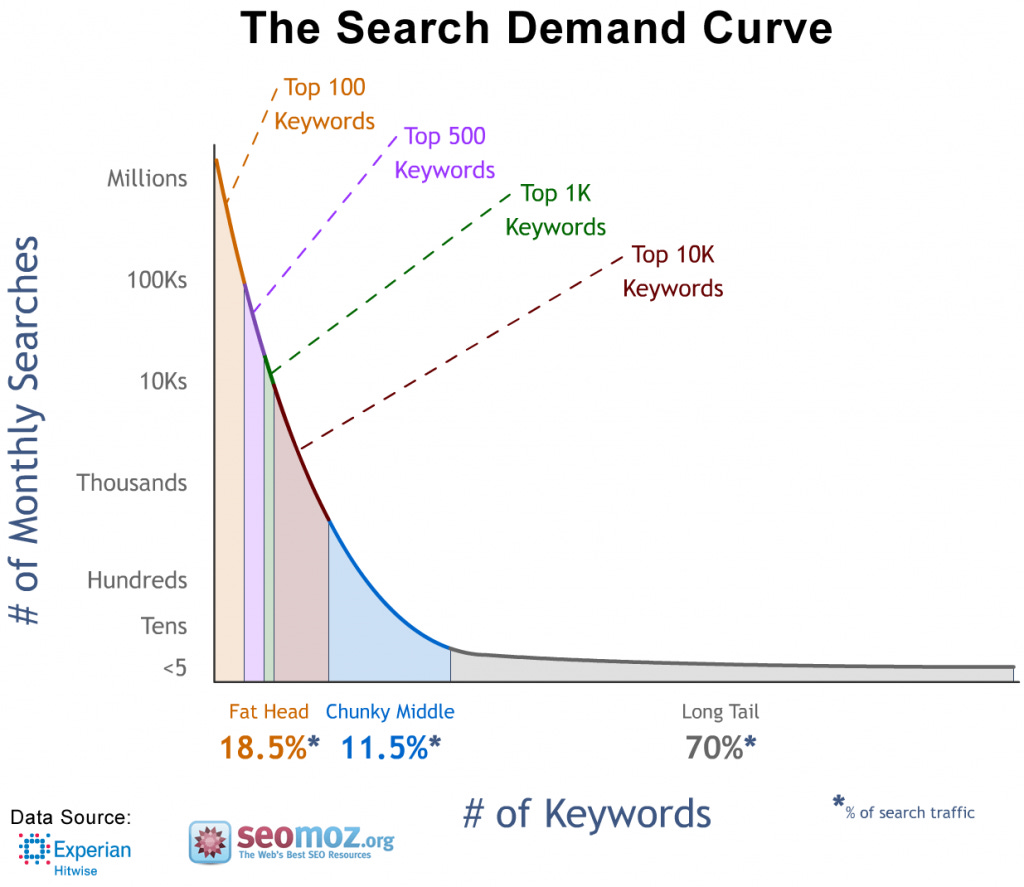

Long tail events refer to the statistical distribution where there are very few occurrences of very large events and very many occurrences of very small events. Let’s take an example of something you do literally every day – Google searches.

The top 10,000 search keywords account for a large majority of searches while there are billions of keywords that account for 70% of the rest of Google searches. Long tails, in simpler terms – the extreme inputs account for an abnormal amount of the results.

So many aspects of your life have been shaped by long tails.

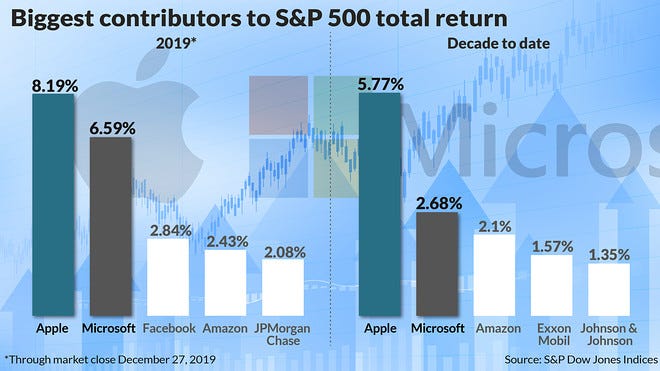

Over the past decade, the top ten stocks have made up almost 20% of the total stock market return. This past year, the top ten stocks accounted for nearly 30% of total returns.

Apple and Microsoft alone account for nearly 15% of all the S&P 500 returns from the last year. This is why passive investing is so popular – because picking the correct stocks is insanely hard.

Venture capital is an industry formed around tail events where half of all startup investments are expected to fail, and the returns of one single company (Stripe, Zoom, Lyft, Twilio) can return the entire firm’s fund and then some.

But that’s just one instance of long tails. Other tail events have even larger impacts. For instance, World War II was directly or indirectly responsible for:

A variety of technological innovations

Massive demographic shifts resulting from 70 million dead and the creation of the baby-boomer generation

The redistricting of countries

The current worldview of capitalism

The U.S dollars emergence as the world’s reserve currency

The founding of organizations such as the World Bank, the U.N., IMF, and NATO.

One event changed life as we know it on this planet. The financial crisis of 2008 had a similar – although not as drastic – impact. The financial crisis altered regulations and elections while inspiring political movements and culture. Long tails drive everything.

The Newest Long Tail: Covid-19

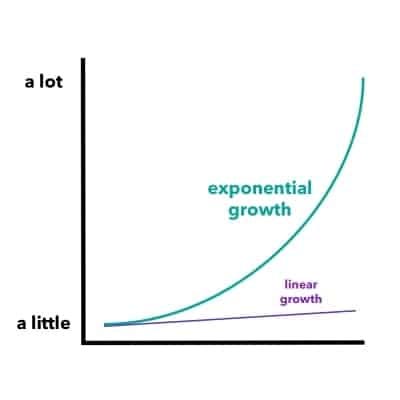

Today, we are faced with a pandemic that grows exponentially and has already brought the world to its knees. I emphasize exponential because the human brain has trouble understanding exponential growth.

Hmmm. I hope you’re thinking, “this looks kinda familiar to the Google searches curve, doesn’t it?”

Yep, it really does. I show you this not to scare you, but to provoke your existing assumptions. It seems as if the Coronavirus is expected to continue its dominance throughout the world.

There are a few major ideas/events that the Coronavirus (Covid-19) pandemic will likely impact over the next year and throughout the 2020s. Here are just some that are on my mind.

The Rise of New Social Movements

This week, the U.S Federal government announced a $1.5 trillion stimulus package that will be loaned to banks to combat Covid-19. Remember how much National Student Debt exists? $1.5 trillion. Who’d get upset about that?

Today, the Fed announced another 700 billion in quantitive easing and cut interest rates to near zero and eliminated reserve requirements. Essentially, banks will be able to take out billions in loans without any money down and with zero interest payable.

Political and social movements are born out of crises. Bitcoin, in part, grew in popularity because of the disdain for the global financial industry after the financial crisis. The Occupy Wall Street movement started in 2011, a few years after the ‘08 collapse. Social and political movements take time. Movements never start during the good times. They start well after things have gone from bad to worse. It takes people getting stomped on repeatedly before they collectively rise up to demand more – sometimes using violence.

More immediately, the U.S political election may be decided by the Trump administration’s response (or lack thereof) to the pandemic. What happens when a global health crisis starts just before an election cycle where healthcare is the number one priority for a large portion of the U.S population? The individuals most affected by the coronavirus are old people, you know, the ones that like to vote.

A year from now, people will determine the coronavirus as the reason your party lost or won this next election. How will the U.S. 2020 President shape the world? My guess: drastically. Long tails change everything.

The Rise of Remote Work

Every company is now remote. Events are going virtual. This year will be a great catalyst for remote-first work as companies have to hire and onboard workers on a remote basis. It may finally prove that remote work can work for most professions.

I expect Zoom and other videoconferencing to become the norm. The business world will (hopefully) realize that lots of meetings aren’t really necessary. I can dream, can’t I? More concretely, once the Coronavirus passes, some major companies will enable their employees to continue to do so. This will help employees move to cheaper cities to obtain a better lifestyle.

The Largest Redistribution of Wealth

Now for the scary part. Millions of people are going to die. There’s a drastic range on this number from 25 million to 50 million depending on where you look. I’m not an epidemiologist so I’m not going to take a guess. But, safe to say, hundreds of thousands, if not millions of people (mostly elderly) are going to die over the next two years. Of course, millions of deaths will drastically reduce the global economy, but it also has another consequence – wealth redistribution.

According to PwC, Millennials and Gen X are anticipated to inherit over $30 trillion from their Baby Boomer parents over the next 30 years. I think it’s safe to assume that this timeline just got moved up, even if just a little.

If you work in financial services, this should scare you. Millennials are likely to switch from their parents’ banking or investment providers.

Fintech > Major institutions. Robinhood > TD Ameritrade. Crypto > Traditional assets.

It’s hard to know the true impact of such a wealth redistribution. Will Millennials finally be able to buy homes? Will Millenials start to have more kids? Does anyone really want to have a kid during a pandemic when hospitals are at max capacity?

A Demographic Shift that Reconfigures Modern Economies

While Millenials postponing having kids for a year or two isn’t meaningfully detrimental to global demographics, there are other consequences for countries that experience large losses in population.

If the upper limits are true – Tens of millions of people around the world will die. I don’t say this callously. If this happens most people will know someone who was impacted and it will create a demographic shift that reconfigures modern economies.

This cannot be overstated.

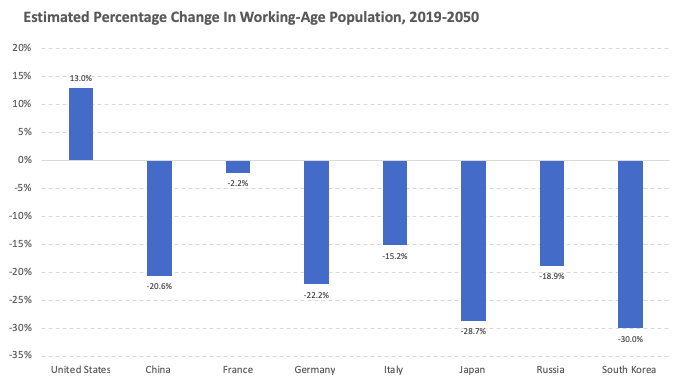

The size of the Baby Boomer generation has impact elections and entire industries. Countries like China, Japan, South Korea, and parts of Europe share similar demographic trends.

Below shows the percent change in the working-age population over the next 30 years. Only the U.S is expected to have a positive growth in the working-age population.

Japan and South Korea are expected to lose over 25% of their working population over the next 30 years. Let’s examine how demographic changes reshape economies. As the global population increases in age, they will require medical professionals such as nurses. Nursing is a well-paying profession and is projected to grow globally over the coming decades.

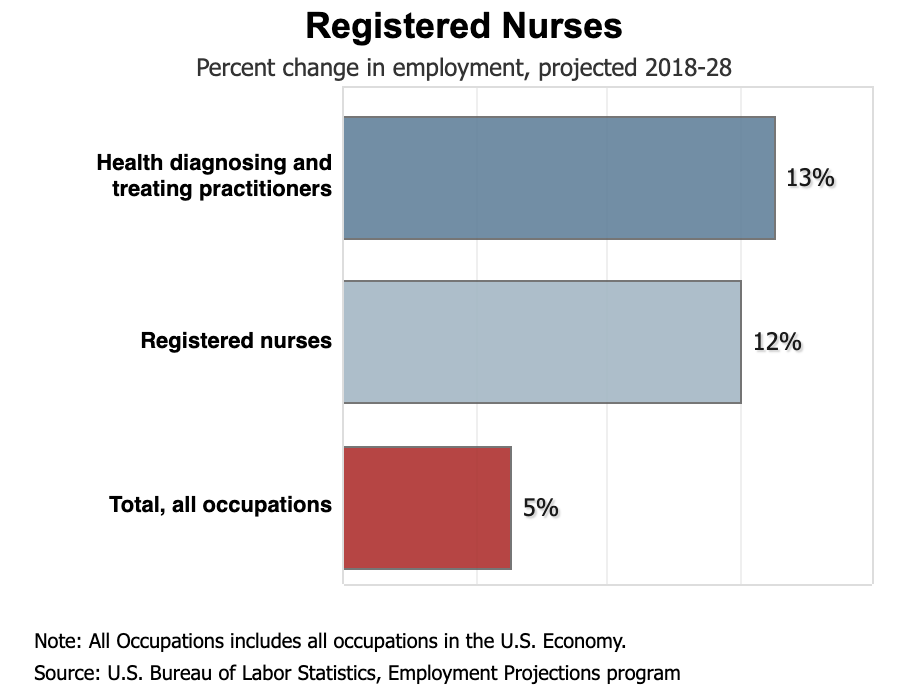

The U.S. Bureau of Labor Statistics projects that the employment of registered nurses will grow 12% (210,400 new positions annually) from 2018 to 2028.

Additionally, the retirement community market is expected to grow with a compounded annual growth rate of 9.7%. This is just one, very simple example of how demographics impact one industry in the entire global economy. Imagine all the other industries, events, and movements that are affected by demographics.

Here’s the kicker – if these countries lose millions of people, then these consequences (positive or negative) are significantly reduced.

Imagine a world where the coronavirus doesn’t kill millions of individuals and China experiences difficulty taking care of its elderly population and small workforce. That impacts China’s ability to compete with other nations. Now, if that “problem” no longer exists, they may be able to more effectively compete with other nations. This is, perhaps a negative outlook, but is one thought experiment of how Coronavirus could fundamentally change the global economy.

Critical Thinkers Will Do Very Well

Zoom will do incredibly well. Bitcoin may potentially gain more followers as people become enraged by the Fed’s neverending bailout of banks and Wall St. Make the bets people aren’t willing to make. Build something everyone needs. Think differently.

Manufacturing Will Become More Domestic

Supply chains around the globe are getting devastated. People can’t get toilet paper and other consumer goods. More importantly, many countries are unable to manufacture virus testing, pharmaceuticals, and other necessary items.

The countries most affected by the virus will remember the shortages. They will work to ensure that they have the capabilities to assure their own citizens have critical supplies. Some countries may even subsidize the manufacturing of critical goods as an allocation of national security. There will be precautions taken and legislation issued so that we can be better prepared the next time around.

Final Thoughts: Some Optimism

For those who’ve lasted it this far, I’d like to share some optimism. Things may get worse before they get better. But eventually, it will be better. Markets hate uncertainty and unfortunately, we are likely staring down the barrel of several months of uncertainty with the coronavirus. The greatest moments, innovations, and changes are forged in times of great turmoil. Things will get better, hang in there.

Advancing Web 3.0 is a weekly newsletter about cryptocurrencies, decentralized finance (DeFi), and technologies that are shaping the next era of the Internet. Welcome to the bleeding edge. Welcome to Web 3.

About the Author: I’m Mason Nystrom, a writer and aspiring angel investor. Previously I worked for ConsenSys as a marketer focused on marketing strategy for ConsenSys and its portfolio companies. Prior to joining ConsenSys, I worked as a Business Analyst at Gatecoin, the first cryptocurrency exchange to list ether, Ethereum’s native cryptocurrency.

I’m passionate about Bitcoin, Ethereum, DeFi, Web 3.0, and all things crypto. When I’m not writing or heads down in crypto, I’m learning to become a developer at Lambda School.

The views, information, and opinions expressed are solely those by the author and are meant for informational purposes only and are not intended to serve as a recommendation or investment advice to buy or sell any securities, cryptoassets, or other financial products.