The State of Crypto Gaming

Get Your Head in The Game

Happy President’s Day. I hope everyone is doing well and that you have a great start to the week.

As the blockchain-based gaming & GameFi sector gains momentum, the gaming infrastructure stack has also quickly evolved and is now composed of an ecosystem of studios, games, and key pieces of infrastructure.

Sponsored By: Messari

Check out the full report (for free) on Messari and catch the highlights in this thread.

As the blockchain-based gaming & GameFi sector gains momentum, the gaming infrastructure stack has also quickly evolved and is now composed of an ecosystem of studios, games, and key pieces of infrastructure.

Executive Summary

The landscape of blockchain-based gaming is rapidly expanding behind the rise of NFTs and in-game currencies. Its growth can be seen as a continuation of a multi-decade iteration across monetization strategies and business models.

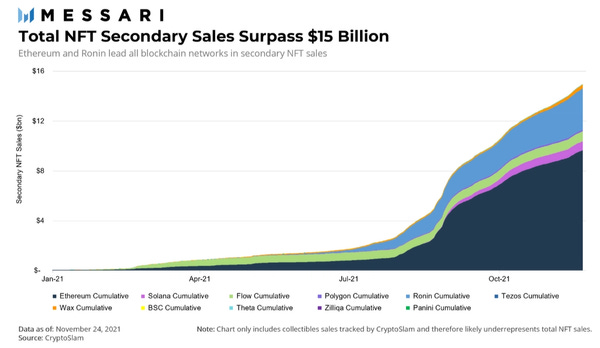

The rise of worldwide interest in video games and non-fungible tokens (NFTs) in the last few years serve as large catalysts. Globally, the number of video gamers is quickly approaching 3 billion with a projected 5-7% compound annual growth rate (CAGR) over the next few years. Meanwhile, NFT sales surpassed $15 billion for the first time ever in 2021. In fact, secondary sales of the NFTs found in blockchain games themselves accounted for 20% of total NFT sales – with dozens of smaller games consistently generating tens or hundreds of millions of dollars in revenue.

Finally, while the metaverse remains vague, it’s clear that gaming, in particular, has a strong presence in virtual worlds. Virtual world games, like Decentraland and The Sandbox, have generated nearly $500 million in cumulative NFT sales (virtual land and in-game assets). In 2021, virtual world NFT sales witnessed the largest growth, generating over $320 million in transaction volume. As the global understanding of the metaverse further contextualizes, it’s likely that some portion of this new digital experience will utilize blockchains as a core piece of infrastructure – something even more likely to occur as blockchain infrastructure continues to scale to meet the demands of developers and consumers.

This report will dive deeper into the growth of all three categories: Global gaming, NFT markets, and blockchain games. Though the industry remains in its infancy, understanding these trends will help provide insights into what the future of gaming may hold.

Introduction to Blockchain Gaming

Like its fictional characters, the business of games keeps evolving. The industry lies at the edge of disruption, where it has historically discovered innovations and adapted them to ever-changing demands.

Take the evolution of gaming business models as an example. The first mainstream games featured a pay-to-play system. We remember these games predominantly as arcade machines in malls or CD discs in computers or, later on, direct downloads onto machines. The advantage with pay-to-play was simple: Pay just one time; keep playing forever.

After pay-to-play came the freemium model of games. Gamers no longer needed to pay to start playing a game in this era. Rather, companies made revenue from players paying to unlock additional components of the game, or more commonly, from sales of in-game purchases such as expansion packs, platform subscriptions, and character cosmetics. For many, freemium games lowered gaming’s barriers to entry and the shift to freemium games helped grow the number of gamers around the globe.

That takes us to today, where the beginnings of gaming’s next monetization revolution lie around the corner: blockchain gaming. The blockchain gaming sector has earned other names like GameFi or play-to-earn indicative of the new monetization models of this gaming era. Blockchain gaming typically incorporates non-fungible tokens (NFTs) or other forms of tokenized assets as in-game content tradeable for cryptocurrencies – or fiat currency – on markets facilitated by the blockchain. Thus, this core monetization strategy occurs in the form of sales of tokenized assets and subsequent royalty proceeds. Game studios and players share aligned incentives in this new business model since both parties benefit when the game’s tokenized assets increase in value.

At the heart of this revolution is the idea that gamers should own the content they earn, or at least have more ownership in the digital worlds in which they spend a significant portion of their time and money. This creates two immediate advantages: (1) The longevity of in-game assets increases as those assets continue to exist in their owners’ wallets even after the game is turned off, and (2) both the interoperability and composability of assets – terms describing their portability – enable them to interact with other games, applications, or blockchains. Interoperability among different blockchains allows gamers to lend out their in-game assets, port them to another application, or gain access to real-world events. In addition, blockchains have the potential to offer gamers the ability to safely and efficiently buy, sell, trade, and create in-game assets with fiat or crypto even within the same application; gray secondary markets for games can be rife with fraud, and many emerging markets lack the payments infrastructure for gamers to seamlessly make game-related transactions.

While blockchain gaming can be a new monetization source for game studios, it should be warned that the decision to enter the world of blockchain doesn’t come without its own pitfalls. The recent announcement of Ubisoft Quartz, an in-game NFT marketplace of sorts, was met with skepticism from fans, leading to plans of including NFTs in the new game Tom Clancy Ghost Recon Breakpoint getting scrapped. This followed after the popular gaming community Discord saw similar pushback after hinting at integration with Ethereum. The main reasons behind the community pushback were sustainability, unclear user value proposition and the prevalence of rug pulls, among many others. Many if not all of these concerns could have been avoided or alleviated with more deliberate, thought-out rollouts alongside market education; introduction of NFT profile pictures by Twitter and Adidas’ foray into NFTs have shown an encouraging path forward for platforms and intellectual property owners to learn from.

The Global Gaming Market

Gaming is one of the most popular sources of entertainment and it is only expanding. Major franchises such as Fortnite and League of Legends now operate in the global pop culture arena. Fortnite, for example, has partnered with Marvel Studios, Star Wars, and John Wick in the movie industry, worked with Ariana Grande, Neymar, and other influential celebrities, and coordinated with popular brands such as Balenciaga, Ferrari, and Air Jordan. League of Legends, on the other hand, hosts an international-sports league drawing millions of fans.

Anecdotes aside, the global gaming market cannot be evaluated without taking the last two years into perspective. In 2020, lockdowns caused by the Covid-19 pandemic acted as a strong catalyst for the industry. Those who were already gamers found themselves with more time to play their favorite games. Meanwhile, individuals who didn’t play games found themselves with time on their hands to experiment with fresh hobbies. Consequently, global gaming revenue grew 15% in 2020. Mobile, PC, and console games each saw growth with mobile, in particular, surging 26% year over year.

Unfortunately, businesses in 2021 faced a different story. The pandemic’s prolonged disruptions began to highlight unexpected second-order effects in the global gaming market. Disruptions to manufacturing, freight, and logistics processes hindered the launches of next-generation consoles, and PC hardware faced chip shortages and delays on other high-end components.

Despite the ongoing increased interest in gaming seen in 2020, both PC and console segments saw slight decreases compared to 2020 and mobile was the only category to experience growth, due to these supply chain disruptions and tough comps.

Forecasts do expect the gaming industry to revert back to the previous levels of growth once the effects of Covid-19 subside. Predictions have the industry reaching $269 billion by 2025, a 53% increase from recent numbers. Over the upcoming three-year period, these fall in line with recent years’ historical 15% CAGR growth, driven by continued changes in consumer behavior post-pandemic and new revenue monetization models from streaming and professional esports.

Meanwhile, the number of total gamers worldwide is predicted to hit just under the three billion mark with 55% coming from the Asia-Pacific region. The main drivers for an ever-increasing user base remain an expanding internet population, better networking infrastructure, and easier accessibility to smartphones.

These three drivers outlined continue to be reliable for the short term, but as more of the world comes online in regions such as the Middle East, Africa, and Latin America and user growth slows, exploring new avenues to increase participants will be of interest to many companies. Blockchain gaming and its new token-based monetization models present a unique opportunity for game developers to generate more in-game revenue per customer, broaden their customer base, and explore new revenue streams.

NFTs: Game Changers

Non-fungible tokens (NFTs) act as a core primitive for blockchain assets and as a key value proposition of various blockchain games. NFTs in blockchain games provide various benefits to games including asset ownership, asset programmability, and open new opportunities to incentivization and innovation.

Asset Ownership

In legacy games, in-game assets are controlled and owned by the game developer and effectively rented out to players. Comparably, in blockchain games, players retain genuine ownership over their digital assets, whether in-game currency or more unique assets like skins, account names, in-game land, or other assets.

Asset Programmability

Since NFTs are essentially software on blockchain networks, these assets can be programmed to have various qualities or built with in-game utility. NFTs can be designed with single-usage, unlockable content, issued to players that achieve a certain status, or programmed with a number of other unique use cases.

Incentivization and Innovation

Game developers are already amongst the most knowledgeable when it comes to incentives. NFTs offer an additional layer of economic incentives by enabling players to earn yield-generating assets, imbue gaming assets with real financial value, and build a more robust gaming economy via in-game currencies and NFT marketplaces.

Since blockchain networks are permissionless, they open up the doors to developer innovation. With NFTs, a single asset category can be automatically licensed to other companies or leveraged in other games. Sorare – the fantasy soccer NFT game – has licensed the usage of its NFTs with other game developers like Ubisoft.

Finally, NFTs also open new forms of monetization. For instance, NFTs issued by companies can earn royalties on all secondary sales producing a new revenue stream for digital asset issuers. Companies can choose to vertically integrate their own marketplaces and activities or integrate with third-party platforms like OpenSea.

The Growth of NFTs: Secondary Market Sales

Total NFT secondary sales in 2021 surpassed $15 billion across multiple blockchain networks. As a platform, Ethereum leads NFT sales. However, increased transaction costs on the network have paved the way for newer blockchains and Layer-2 scaling solutions like Solana, Ronin, ImmutableX, Polygon, and more.

Each blockchain or Layer-2 comes with its own set of tradeoffs, including scalability, existing infrastructure, users, and security among others. As such, there’s a variety of game developers building on different blockchains for different reasons. Games that require greater scalability might opt for blockchains like Solana while game developers desiring to utilize Ethereum’s

existing network effects may select Polygon, ImmutableX, or another Ethereum scaling solution.

In hindsight, August 2021 was the peak monthly activity in 2021 with over $4.5 billion in NFT secondary sales.

Although the last few months of 2021 still lagged compared to the peak, it’s important to realize the NFT secondary market is still multiples larger than where it was at the start of 2021. With a growing number of applications and marketplaces that integrate various forms of tokens including NFTs, the NFT secondary market will be poised to retest the level of engagement last seen during August 2021.

Note these charts represent secondary sales, meaning the sale from one person to another. This data, therefore, excludes the initial NFT sale from the gaming company to the first buyer, which can produce meaningful revenue. Secondary sales are a useful metric for gauging the health of both the overall NFT market and the health of an individual game. Increased secondary sales likely translate to a more robust gaming economy and since NFT collections often pass a perpetual royalty to the company at each sale, a healthy secondary market also directly corresponds to increased revenue for the NFT issuer.

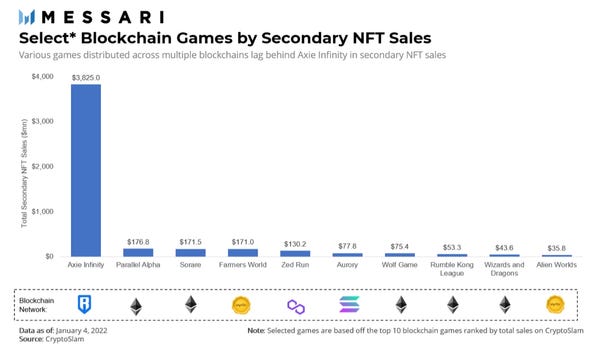

Data shows Axie Infinity is the clear leader in secondary NFT sales, the vast majority of which occur on its sidechain Ronin. More recently, ParallelAlpha, another strategy card game, has grown in recent months in part due to its intriguing SciFi backstory and intellectual property. Overall, there exist several successful games with over $100 million in secondary NFT sales across multiple blockchain networks, showing that there’s still no clear consensus on which platform is best suited for blockchain-based games.

Also worth mentioning is the fact that most successful blockchain games today are predominantly card games, compared to the existing gaming industry which favors sandbox games, MMORPGs, and games with more robust gaming experiences.

Currently, blockchain games are not at the stage of development in which they can support both complex gameplay and economic primitives like NFTs at scale. However, in time, advancements in blockchain technology and user experiences – including improvements launching in the coming year – will open the doors for higher functioning games that operate on blockchain networks.

The Crypto Gaming Landscape

As the blockchain-gaming sector gains momentum, the gaming infrastructure stack has also quickly evolved and is now composed of an ecosystem of studios, games, and key pieces of infrastructure.

Let’s break down the various layers of the blockchain gaming landscape.

Gaming Guilds

Guilds aren’t new to blockchain gaming. These social groups – guilds – have been utilized in role-playing games for decades. However, the combination of decentralized autonomous organizations (DAOs)—an entity formed by a community that is organized around a set of rules enforced on a blockchain, usually with no central leadership structure—and gaming enables these guilds to ingest and allocate capital which creates new models for gaming financialization and user acquisition. Well-capitalized guilds like Yield Guild Games, GuildFi, and Merit Circle have sponsored—delegated assets in exchange for part of the game rewards—hundreds of players for games like Axie Infinity.

Blockchain Games

The largest layer of the blockchain gaming landscape is the games themselves. To date, there exist a variety of game types. Some of the most successful categories include trading card games (e.g. Axie Infinity), MMORPGs(e.g. DeFi Kingdoms), Virtual Worlds (e.g. The Sandbox), and sports games (e.g. Sorare).

As the gaming landscape evolves, dominant blockbuster games will emerge from each sector. However, many games are currently under development and may take months or years to fully develop.

Marketplaces

As games issue assets as NFTs, general marketplaces like OpenSea offer access as well as blockchain-specific marketplaces like Metaplex, VIVE, and Magic Eden that facilitate transactions. Further, some pieces of gaming infrastructure like Enjin offer their own marketplaces for Enjin SDK-developed games.

Launchpads

Launchpads effectively help upstart game developers raise capital for game development. Often these launchpads raise capital for a specific gaming ecosystem (i.e. Polkastarter for Polkadot) or Magic Eden for Solana). Typically, launchpads enable fundraising through either an initial DEX offering (IDO) or liquidity bootstrapping pool (LBP), each of which enables the initial sale of tokens.

Gaming Development Infrastructure

Game development infrastructure like Forte and Enjin often have APIs and SDKs that enable game developers to quickly integrate NFTs or other crypto-economic activities. Building the entire blockchain infrastructure required for a game from scratch can be daunting and time-consuming for game developers. Just as blockchain developers leverage existing smart contract tooling and wallet infrastructure, game developers can leverage blockchain game development software (i.e. Stardust, Enjin, Forte) that supports modular components such as wallets, asset issuance, payments, and other foundational features.

Layer-2 Infrastructure

The NFT bull market of 2021 resulted in increased investment from Layer-2s into the gaming ecosystem. Axie Infinity chose to vertically integrate, developing its own sidechain, Ronin, and its own DEX, Katana. Elsewhere game development platforms like Enjin have chosen to horizontally integrate, recently securing a Polkadot parachain auction for Efinity. Still, many existing games are committed to building on Ethereum’s existing network effects, leveraging Starkware (e.g. Sorare), ImmutableX (e.g. Gods Unchained), Polygon (e.g. Zed Run), and others for their scaling needs.

Layer-1 Infrastructure

Layer-1 infrastructure serves as the core foundation for various protocols and applications. While some games are building higher throughput blockchains like Solana and Flow, most Ethereum games have migrated to Layer-2 solutions. The importance of Layer-1s comes from the other composable protocols that games will leverage, including guilds, financialization protocols(e.g. NFTX), identity solutions (e.g. ENS), marketplaces, and other applications or services.

Game Studios

Studios sit at the base layer of the landscape since they are often developers of games as well as Layer-1 and Layer-2 infrastructure. Dapper, Sky Mavis, and Animoca Brands sit as the most well-capitalized game developers with hundreds of millions in capital. Ultimately, not every gaming studio will survive. However, those that develop the next blockbuster games have the potential to become the next Electronics Arts of the future.

Check out the full report on Messari.

Curated Content

Decentralization doesn’t matter, until it does.

Don’t lose conviction.

All the important crypto events of last week.

An analysis of The Sandbox LAND plots.

People are hyped about crypto gaming.

veTokens and valueless governance tokens.

A list of good resources for token economic design

See you next week, probably.