The Next Great Bundling: Markets and Media

Let's bet on this sh*t.

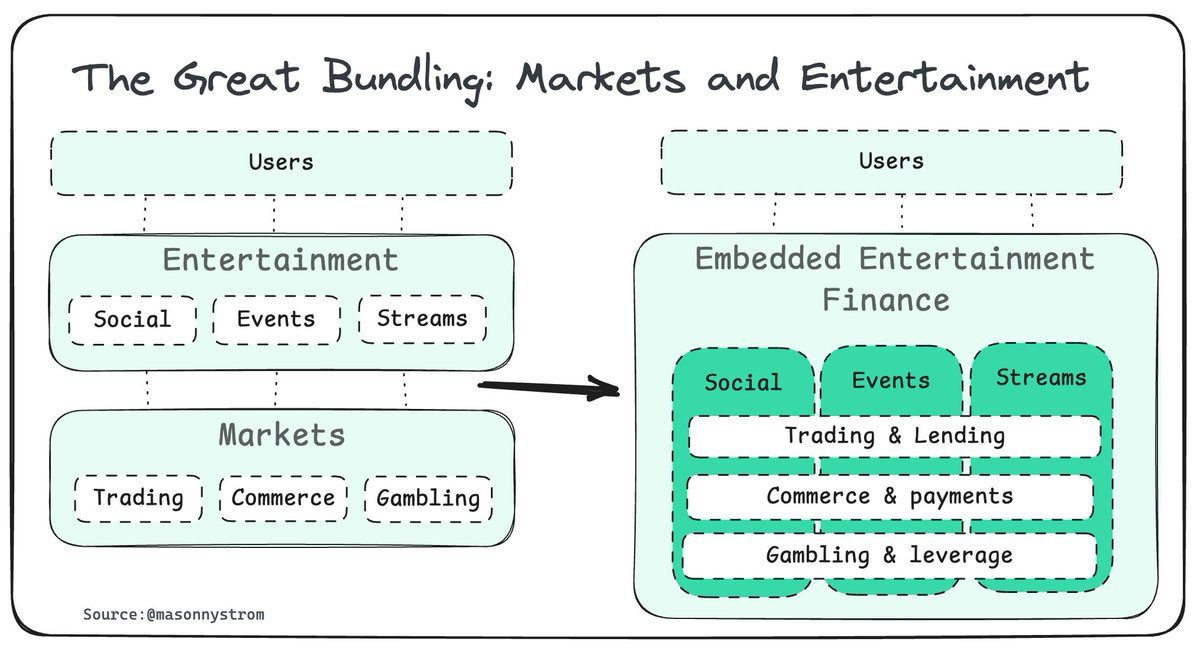

The next great bundling will be of markets and media.

For anyone that’s ever bet on an NFL game, you immediately realize that it feels like a levered form of entertainment.

The addition of financial gain or loss, amplifies the entertainment experience. This same experience, often amplified by volatility, is what has propelled prediction markets, memecoins, and the trend towards broader financialization of everything.

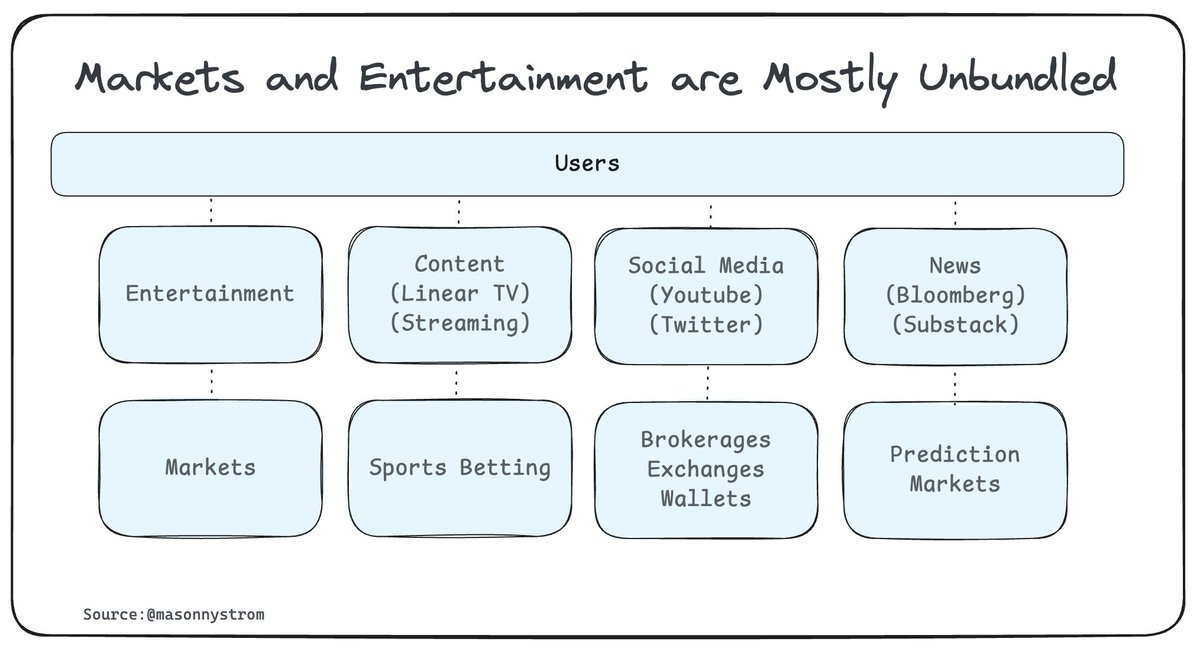

But, today, markets and entertainment are mostly unbundled. That is to say, where you bet and where you get entertainment are decoupled.

Discovery is distinct from trading. People see what they want to buy on Twitter (I’m still not calling it X), see a friend share a memecoin in a group chat, or hear about an asset on a podcast and then open their brokerage account to slam the “market buy” button, slippage and fees be damned.

The next great bundling will be of media and markets. Entertainment and finance. Livestreams and leverage. Culture and prediction markets.

As more assets move onchain and internet capital markets mature, interfaces and front-ends will have a broader asset universe and more financial products that they can offer to their users.

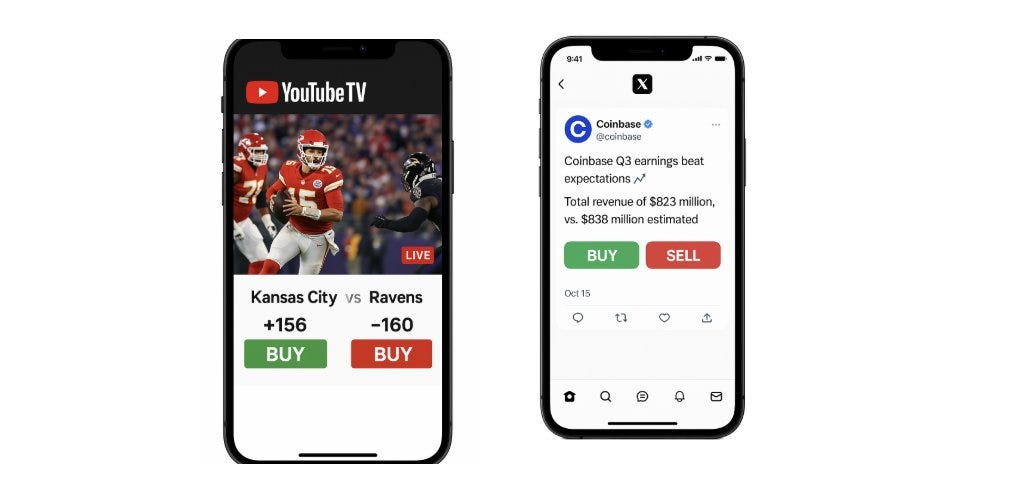

Twitter could easily be a venue where $TICKERs have integrated purchases options or embedded sports betting within social networks powered by underlying prediction markets.

It’s worth noting that in some instances the orderbook is the entertainment – watching an asset go up or down elicits emotional reactions that when coupled with social experiences (comments, follows, socials, etc.) breed higher entertainment value.

Internet capital markets will bundle the moment of attention and the moment of monetization. The feed merges with the terminal. Culture can produce live events and shows that are interwoven into the trade. Media and markets, once separated, will now forever be intertwined.

Does fantasy football need to be tokenized?

‘Medium is the message’