The Life of an NFT Trader

You're probably not making money trading NFTs

What makes a good NFT trader? A recent report by Chainalysis provides unique insight into the most successful NFT flippers.

Sponsored By: Messari

The Secrets of the NFT Flipooooorr

The first insight into NFT collections is that OpenSea whitelisting largely determines if a collection is able to return a positive return on investment. Non-whitelisted (verified) projects have a harder time achieving significant returns.

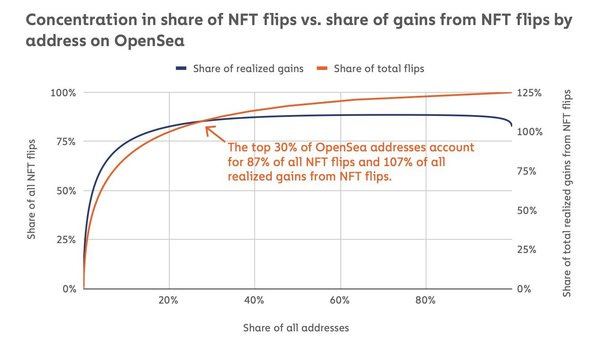

Importantly, NFT flipping is a long-tail game, with the top 30% of user addresses on OpenSea accounting for 87% of secondary NFT sales.

The Makings of an NFT Trader

Further analysis from Chainalysis shows the specific traits and patterns of a successful NFT investor. After categorizing five Groups of NFT flippers, the most successful investor group is Group 1. This distinguished group flipped significantly more NFTs on average than all the other groups, flipping 2.5x as many as the next closest group.

Not only did this group flip the most NFTs, but they also purchased NFTs across nearly double the number of unique collections which increases their odds at achieving a successful flip.

Finally, and maybe contrary to popular belief, the best NFT traders on average spent .25 ETH more per NFT than the next closest group.

Even more telling is that the top 5% of NFT flippers paid, on average, 2.2 ETH per NFT. This likely implies that it’s easier for an NFT collection to appreciate from 2 ETH to a higher price than it is for a lower-priced NFT to garner a moderate price. In essence, it appears that once an NFT collection reaches a threshold price, its chances of appreciation greatly improve as it no longer has to compete with the vast majority of other collections. Obviously, this strategy greatly benefits NFT investors with capital, which is largely why the majority of NFT volume is comprised of institutions and high net worth NFT collectors.

If there’s one takeaway from the report for retail NFT collectors it’s this – retail NFT collectors would be better suited if they purchase higher quality NFTs as opposed to lower-priced NFTs which have a lower chance of appreciating in value. Still, if you’re a retail investor it’s important to understand who you’re investing against. The odds are stacked against retail investors who possess less capital and therefore obtain fewer shots on goal and remain concentrated in a smaller number of collections. And if you have to ask if you’re the sucker..well maybe this year will be different.

Curated Content

2022 predictions, so hot right now.

Where does value accrue in a modular world?

Don’t sleep on the Cosmos Theta Upgrade.

The South Park writers are absolute geniuses.

The Smartweave rises.

FlamigoDAO buying Brainssss makes others want brains.

SeedClub $CLUB launches. 👀

Thanks for reading, see you next week, probably.