The Hot Start Problem

When speculation is a feature vs a bug

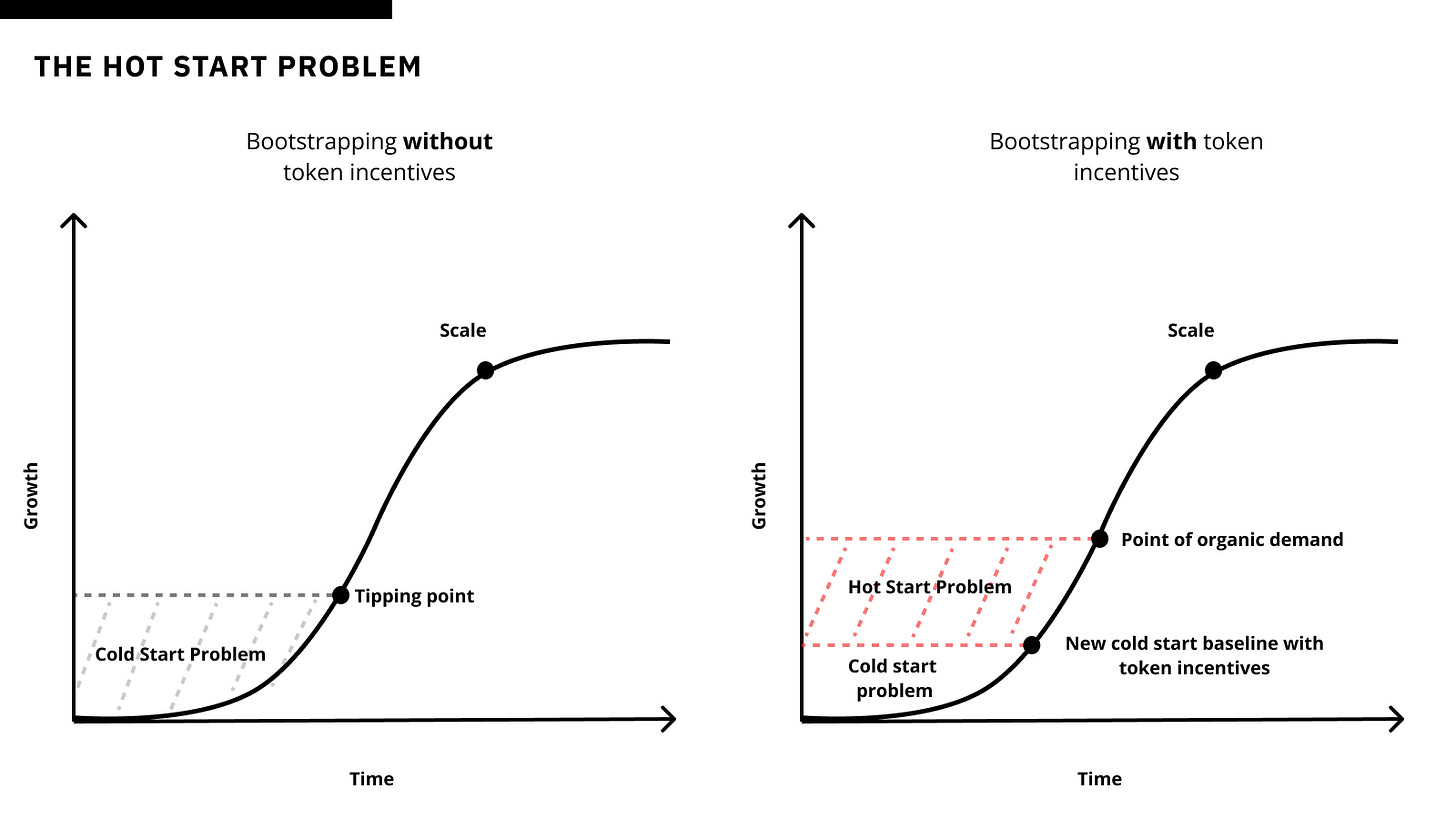

When combined with new and innovative products, tokens – or the promise of tokens – have proven effective at alleviating the cold start problem. But while speculation brings the blessings of network activity, it’s also accompanied by the spoils of short-term liquidity and inorganic users.

Marketplaces and networks that launch with a token from the jump (or before establishing sufficient organic demand), must find PMF in a shortened window or they’ll otherwise spend their proverbial tokenized bullets from the growth gun.

My friend and fellow investor, Tina calls this the “hot start problem” where the presence of a token limits the window of time a startup has to find PMF and gain enough organic traction such that the startup can retain users/liquidity as token rewards diminish.

Apps that launch with a points system, also encounter the hot start problem as there’s now an implicit expectation of tokens from users.

I quite like the framing of the “hot start problem” since a core differentiator of crypto compared to web2 is the ability to leverage tokens – financial incentives – as a tool to bootstrap new networks.

This strategy has proven effective, especially from the likes of DeFi protocols such as MakerDAO, DyDx, Lido, GMX, among others. Token bootstrapping has also shown to be effective for other crypto networks from DePIN (e.g. Helium) to infrastructure (e.g. L1s) and certain middleware (e.g. oracles). However, networks that opt into the hot start problem by blitzscaling with tokens face several trade offs including, obfuscating organic traction/PMF, pre-maturely spending the proverbial bullets from the growth gun, and adding friction for accomplishing operational tasks because of DAO governance (e.g. fundraising, governance decisions, etc.)

Opting Into The Hot Start Problem

The hot start problem is favorable to the cold start problem in two scenarios:

Startups competing in red ocean markets (markets with a high degree of competition and known demand)

Products and networks with passive-supply side participation

Red Ocean Markets

The core disadvantage of the hot start problem is the inability to ascertain organic demand, but that problem is lessened when building in a category with robust product market fit. It is in this instance that the second movers, by launching a token early, have the potential to successfully compete with earlier market entrants. Defi offers the most examples of second-movers overcoming the hot-start problem, effectively leveraging tokens to bootstrap new protocols. While Bitmex and Perpetual Protocol were the first centralized and decentralized exchanges to offer perps, later entrants like GMX and dYdX leveraged tokens to quickly grow liquidity and become perp category leaders. Newer DeFi protocols within lending like Morpho and Spark have successfully bootstrapped billions in TVL compared to first movers like Compound, although first mover, Aave (formerly ETHlend) still reigns supreme. Nowadays, when there’s clear signs of demand for new protocols, tokens (and points) are a default of the liquidity bootstrapping gameplan. For instance, liquid staking protocols have aggressively leveraged points and tokens in order to grow liquidity in a highly competitive market.

Elsewhere in crypto consumer land, Blur showcased the playbook for competing in red ocean markets with its market-defining points system and token launch that catapulted Blur into a dominant Ethereum NFT trading venue by trading volume.

Passive vs Active Supply-side Participation

The hot start problem is easier to overcome in passively supplied networks compared to actively-supplied networks. The brief history of tokenomics shows that tokens are useful at bootstrapping networks when there’s passive jobs to be done – staking, providing liquidity, listing assets (e.g. NFTs), or set-it and forget-it hardware (e.g. DePIN).

Conversely, although tokens have also succeeded at jumpstarting active networks like Axie, Braintrust, Prime, YGG, and Stepn, the premature presence of tokens often obfuscates true product-market-fit. As a result, the hot start problem is significantly more challenging to overcome in active networks compared to passive networks.

The lesson here is not that tokens are ineffective in active networks, but instead that apps and marketplaces that launch token incentives for active jobs to be done – usage, gameplay, gig work, services, etc – must take extra steps to ensure that token rewards are going towards organic usage and driving important metrics like engagement and retention. For instance, data labeling network Sapien gamifies the task of labeling and has users stake points in order to earn more points. In this instance, passively staking while performing some action has the potential to act as a loss-aversion mechanism, ensuring higher quality data labeling from participants.

Speculation: Feature vs Bug

Speculation is a double edged sword. It can be a bug if integrated too early into a product’s lifecycle, but when done strategically, it can also be a powerful feature and growth tool for garnering user attention.

Instead of tackling the cold start problem, startups that choose to launch a token before gaining organic traction opt for the hot start problem. They accept the trade-off of leveraging tokens as an external incentive to draw user attention while wagering on their ability to discover or create organic product utility amidst increased speculative noise.

i think it also depends on who is the audience for PMF. Example for defi, tokens make sense as the audience intuitively understands it.

But for games, maybe traditional cash driven rewards might work better as projects would want users beyond web3.

Probably its worst for L2's and a lot of infra who are yet to figure out their audience and therefore attract usually the most predatory ones.