Tenderize: Web3 Infrastructure For Liquid Staking & Yield Generation

It's all about the time value of money.

I’m thrilled to share my angel investment in Tenderize – a liquid staking protocol for web3 assets.

Note: this is an independent angel investment and has no connection, legal or otherwise, to Variant Fund.

Tenderize: Yield Generation For Web3 Infrastructure

While liquid staking exists for Ethereum and other layer-1 assets, it’s largely unavailable for other web3 infrastructure assets. Tenderize solves this gap by providing a non-custodial, liquid staking protocol for web3 assets and launched its mainnet in May offering liquid staking for Livepeer (LPT), The Graph (GRT), Polygon (MATIC), and Audius (AUDIO).

To date, Tenderize has garnered nearly $700k in TVL, fairly even split across the first four assets.

How Tenderize Works

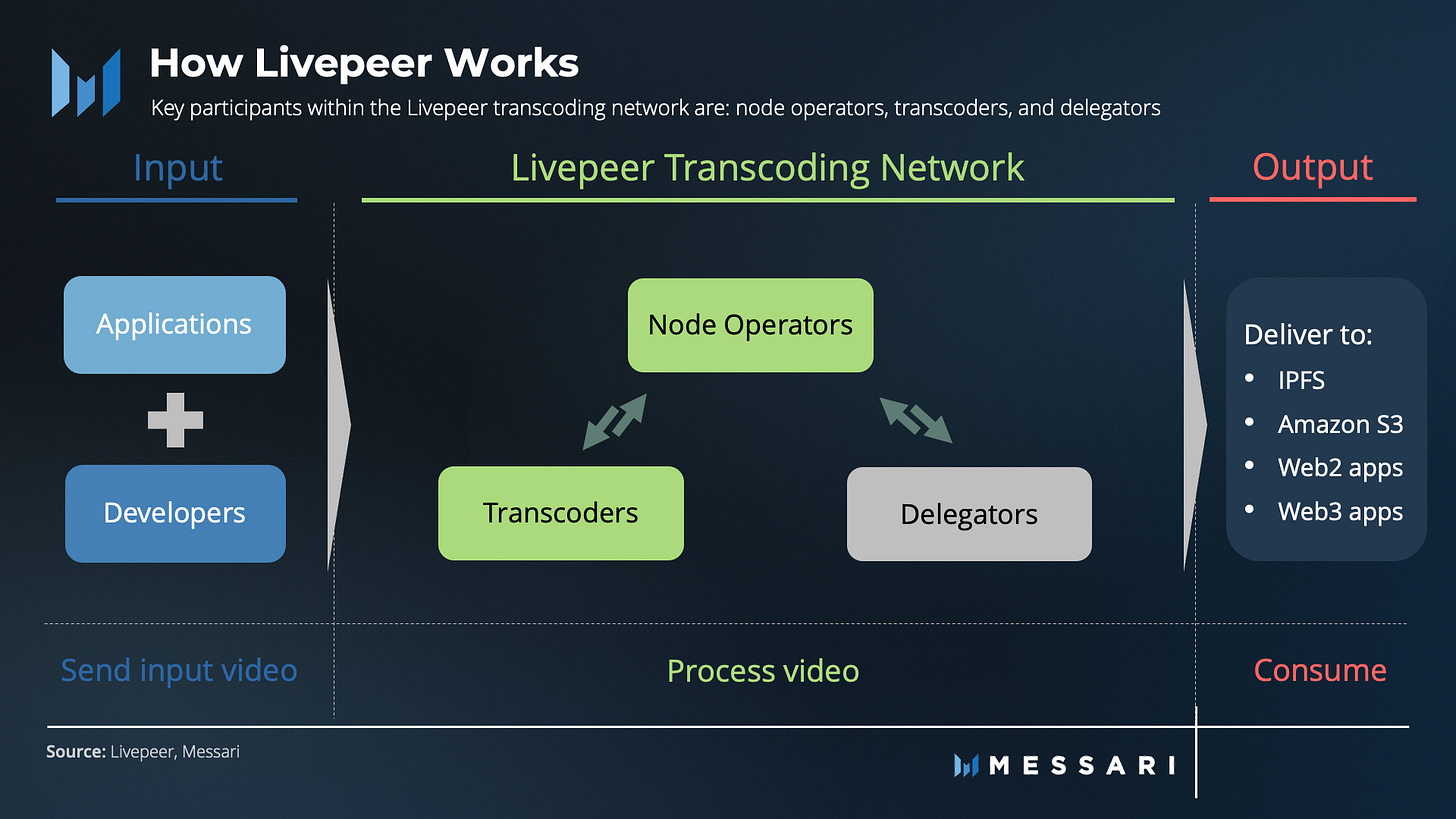

Let’s use Livepeer, one of the largest staked assets on Tenderize as an example. Livepeer requires a node to stake LPT in order to perform transcoding work on the Livepeer network. However, Livepeer also allows for delegation of LPT to a node operator in exchange for a portion of the LPT rewards.

So, lets say you wanted to stake through Livepeer.

Staking Through Livepeer

Normally, you (or an institution) would go to the Livepeer network and select a node to stake. It’s up to you as the delegator to ensure you’re keeping tabs on the most reliable and profitable nodes.

Ideally, you would redelegate your stake (in real time) to a different node in a variety of circumstances:

You want to delegate to a node that shares more rewards (more rewards = more money)

You want to delegate to a node that has better uptime (more uptime = more rewards = more money)

You want to unstake from nodes that you don’t agree with – say if a node is attacking the network or taking a controversial stance on a governance proposal (less stake = less power)

But, the unstaking (unbonding) period for LPT is seven days and you don’t earn any rewards so you’re losing seven days of profits. For other infrastructure protocols like The Graph, the unstaking period is even longer (28 days). Additionally, since your LPT is locked in the Livepeer protocol your staked asset is unusable as tokenized collateral in other protocols or applications.

Nearly all of these instances are examples of delegators or potentially node operators leaving money on the table, losing money for periods of time, or unable to put their assets to productive use.

Staking Through Tenderize

In contrast, using Tenderize you (or any delegator) would deposit and stake LPT into the protocol and receive tLPT (tender LPT). LPT staked through Tenderize is delegated to high profitable nodes and the staking rewards compound automatically, sending the owner more tLPT as its earned. A tLPT owner can always swap back for LPT, use tLPT in other DeFi protocols for additional yield, or sell the tLPT instantly. Over time, Tender tokens will likely trade at a premium to their corresponding tokens (e.g. tLPT vs LPT) given their instant liquidity and potential yield-bearing nature.

The benefits of liquid staking effectively boil down to the first lesson in an undergraduate intro finance class – the time value of money. A dollar today is worth more than a dollar tomorrow. In the case of Tenderize, a dollar that you can use today is more valuable than a dollar seven to twenty-eight days from now. Stakers who are unable to wait the unstaking period or that want to utilize their assets productively for extra yield will pay the premium to do so while those who are willing to pay less for the underlying LPT token will take the tradeoff in time.

A Liquid Moat & Protocol Controlled Liquidity

Web3 infrastructure is also complex. Protocols like The Graph and Livepeer have various stakeholders and will necessitate delegation for growth. Tenderize encourages this by enabling greater alignment between capital allocators and node operators. The protocol automatically compounds rewards on a regular basis and staked delegations to nodes are managed by node profitability and reliability. This streamlines the process for investors and incentivizes competition among hardware providers.

Perhaps most importantly, as Tenderize expands it will naturally accrue substantial protocol-controlled value (liquidity) that can be used to earn yield across the broader DeFi ecosystem.

The market size of web3 infrastructure for a decentralized internet stack is so large that it’s often underestimated. In 2022, the revenue estimation for global network infrastructure was over $200 billion, while Amazon Web Services alone generated $62 billion in revenue last year. Imagine a world where many of the services provided by today’s tech giants are unbundled such that we have computation, storage, bandwidth, indexing, and other data management protocols. Tenderize provides a mechanism to financialize the web3 infrastructure of tomorrow.

If you’re interested in joining Tenderize, they’re hiring!