Revolutionizing the Firm

How DAOs can expand what it means to be a company

Revolutionizing the Firm

Companies are just legal constructs that we as a society have agreed upon. Humans have used coordination mechanisms like the joint-stock company since the Tang dynasty (618–907). As centuries past, our ability to coordinate capital grew as did the power these companies possessed.

Those of you who have read Yuval Harari’s book Sapiens, are well aware of the military might of Dutch East India Company and that it was the richest company (adjusted for inflation) in the history of capitalism ($7.8 trillion).

The Dutch East India Company fell for a myriad of reasons, one primarily being the corruption that plagued the company. As we examine our society today, many corporations and governments are plagued with corruption.

There are two primary causes of society’s corporate influence and corruption:

Our system incentivizes short-sighted thinking and not long term rewards.

Most of the world’s systems, corporations, and governments are operated by a handful of individuals.

I believe the best decisions are made when an informed and passionate community is at the helm.

In some instances, merely greater access to voting or governance can result in huge improvements. Increasing access to corporate governance is one area where increased access can benefit society.

Governance refers to the process of decision-making and the process by which decisions are implemented (or not implemented).

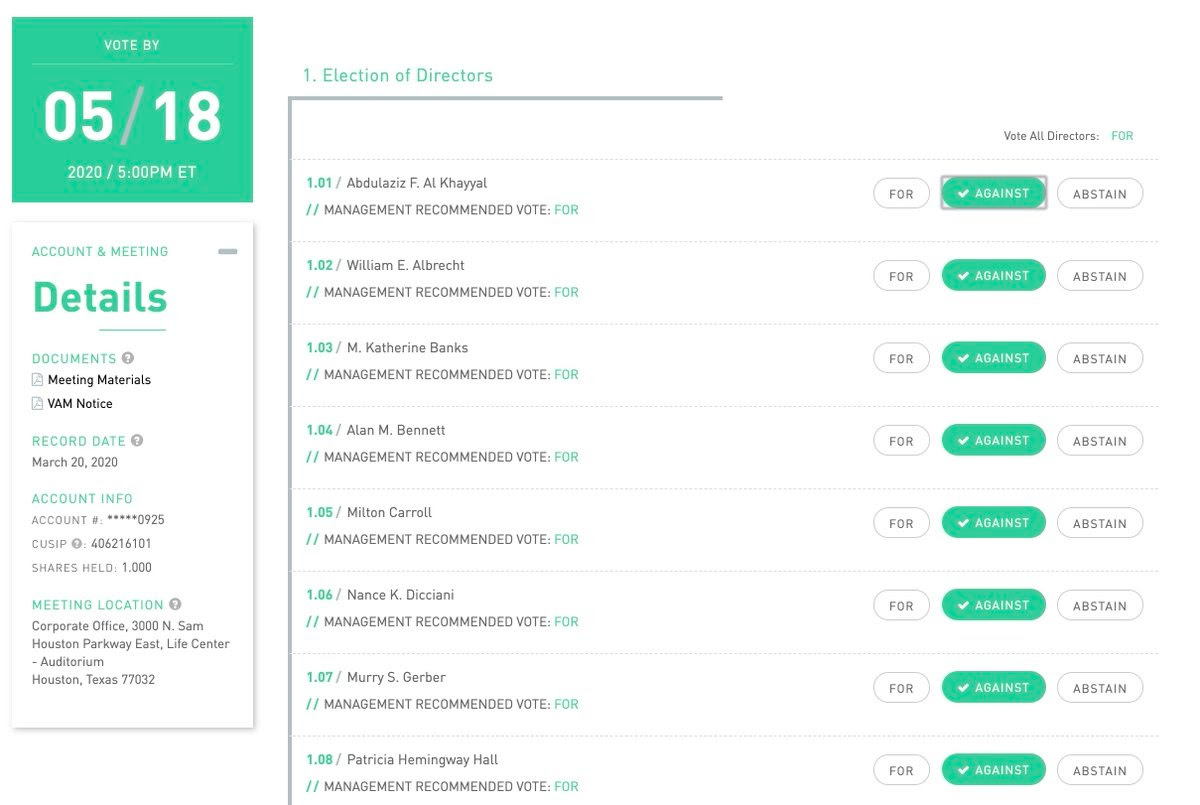

Robinhood makes it incredibly easy to vote as a shareholder. People vastly underestimate the potential effect that this will have on the governance of publicly-traded companies.

Never before has an entire shareholder base possessed a seamless way to vote on proposals or management executive appointments. Combine this seamless voting with the massive power of social networks and suddenly the public has the opportunity to coordinate decisions.

While Robinhood’s app is a major improvement to corporate voting, companies are predominantly run by a Board of Directors that fail to take into account the opinions and ideas of other stakeholders and employees. Most company boards think on a quarterly basis and prioritize short term profits because they are incentivized to increase the company’s stock price. This is a clear misalignment of incentives that destroys long term shareholder value and causes negative externalities (i.e. pollution, data manipulation, fake news).

The ability to expand the board to 100 people or even an entire company presents a novel and democratizing solution. The cost of group coordination is one reason that companies have not adopted wider stakeholder governance. New organizational structure underpinned by software greatly reduces the cost of coordination.

Expanding The Definition of the Firm

A DAO is a Decentralized Autonomous Organization. A DAO is a smart contract that individuals can use to effectively coordinate without legal signatures or approvals. More broadly, you can think of a DAO as a group of shareholders that utilized software to enhance decision making.

Today, DAOs are experimental but promising. They are being used to more effectively coordinate capital and push the boundaries of how people can organize. MetaCartel Ventures is a DAO operating as a venture capital fund. Similar to a traditional VC fund, MetaCartel Ventures has members that vote on where the fund should allocate its capital.

Just like there are different forms of companies (Corporations, LLC, LLP, B-Corps) there are also different structures of DAOs including dxDAOs, Moloch DAOs, and Aragon DAOs. These structures are similar in nature but come with different operating/governance features.

In order to merge the traditional corporate world with Web3, the team at OpenLaw spearheaded a project called the LAO. The LAO (limited Liability Autonomous Organization) is a version of a DAO in the form of an LLC. So the organization has a legal entity registered in Deleware (like most LLCs) and a software structure from its smart contract.

Raid Guild, a company building DAO infrastructure recently released an upgrade to the LAO that enables it to create subsidiary DAOs that are still controlled by the parent DAO

The Future of Governance

As this evolves, new governance and company structure will hopefully be created that realign incentives that naturally create better outcomes. Slowly, the definition of what it means to be a company is changing. It will only take one breakout DAO or new organizational structure to cause a paradigm shift. Of course, it won’t be IBM or Google that adopt these governance structures. It will happen at the edges of the tech landscape.

Imagine a world where gaming clans operate with DAOs or where the most successful venture capital fund is a group of 150 individuals all coordinating asynchronous. These are the near term possibilities. What lies further ahead, is more exciting.

Advancing Web 3.0 is a weekly(ish) newsletter about cryptocurrencies, decentralized finance (DeFi), and technologies that are shaping the next era of the Internet. Welcome to the bleeding edge. Welcome to Web 3.

About the Author: I’m Mason Nystrom, a Research Analyst at Messari covering companies and cryptoassets at the intersection of Web3.

Previously I worked for ConsenSys as a marketer focused on marketing strategy for ConsenSys and its portfolio companies. Prior to joining ConsenSys, I worked as a Business Analyst at Gatecoin, the first cryptocurrency exchange to list ether, Ethereum’s native cryptocurrency.

I’m passionate about Bitcoin, Ethereum, DeFi, Web 3.0, and all things crypto. When I’m not writing or heads down in crypto, I’m learning to become a developer at Lambda School.

The views, information, and opinions expressed are solely those by the author and are meant for informational purposes only and are not intended to serve as a recommendation or investment advice to buy or sell any securities, cryptoassets, or other financial products.