NTX: NFT LIquidity

NFTX-rated

gm Unsydicators – we’re nearing the final stretch to the holidays. Hope all is well and don’t forget to tax lost harvest before the end of the year. This is your final reminder.

As a reminder, I’ve recently switched my newsletter from Substack to Revue since it integrates directly with my hobby addiction, Twitter.

Please subscribe on Revue! Or subscribe here and I’ll shamelessly port your email over.

This week we take a deeper dive into NFT liquidity – a space that will undoubtedly expand over the coming years. Specifically, we’ll look at NFTX an NFT marketplace and examine the platform’s growth since its V2 launch.

Sponsored By: Messari

Messari subscribers can read the full report on Messari. Check out Messari’s new product Governor: a governance aggregator and voting platform. It’s free to

NFTX: NFT Liquidity Marketplace

NFTX is a marketplace and liquidity protocol that facilitates buying and selling of NFTs.

Collectors can deposit whole NFTs into an NFTX vault and mint fungible tokens (vToken) that represent the value of the NFT. At any point, the collector can use their vTokens to purchase a random asset from within the vault. Alternatively, an individual can redeem a specific token from the same vault by paying an additional fee (termed target redemption).

NFTX’s design provides several key benefits to various stakeholders, the primary of which are earning yield on idle assets & instant liquidity.

Non Fungible Yield

In order to earn fees on the vault transactions, a collector must stake their vTokens in the respective liquidity pool. Every time an individual mints (sells) or redeems (buys) an NFT, stakers earn a fee from the respective NFTX vault. Finally, stakers who LP into the SushiSwap pool can also receive trading fees for their respective assets.

Sweet, Instant Liquidity

One feature enabled by NFTX’s model is that users can obtain instant liquidity for NFTs with high vToken liquidity. For instance, a BAYC owner can immediately deposit their Bored Ape into the NFTX vault obtaining BAYC vTokens. However, instead of staking the BAYC vTokens, the owner can market sell the tokens on a decentralized exchange like SushiSwap. If liquidity is poor, an NFT owner might sell the NFT for less money than on an exchange like OpenSea, however, the ability to obtain instant liquidity is potentially worth the haircut in price.

While NFTX NFT growth remains somewhat stagnate in November, it has steadily increased over the past several months, and very few days throughout November witnessed net negative NFT deposits.

NFTX DAO

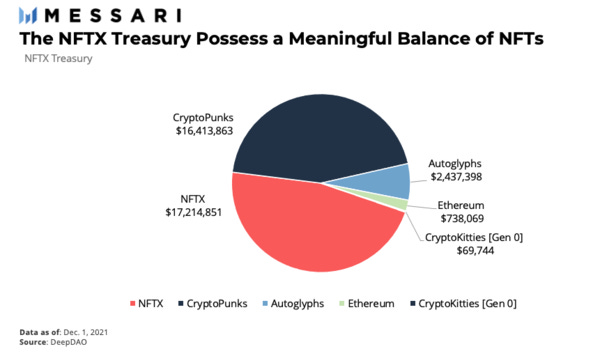

The NFTX protocol and marketplace is governed by the NFTX DAO. Interestingly the NFTX DAO’s has purchased high valued NFTs including CryptoPunks and Autoglyphs most of which the DAO has allocated into NFTX vaults. Finally, NFTX also possesses $25 million in xSUSHI (staked SUSHI). This places the NFTX DAO balance sheet at ~$60 million of assets as of Dec 9th while the protocol maintains a fully diluted valuation of ~$55 million.

Although NFTs are experiencing a slump, the overall market remains stronger than it was just six months ago. As the long tail of assets continue to get tokenized, a large percentage of them will be NFTs due to their non-fungible nature. The overall market for non-fungible liquidity services is large given the benefit these protocols provide to asset owners and capital allocators.

Although NFTX is by no means guaranteed to dominate the NFT market for liquidity providers at this point in time, the marketplace is putting up formidable numbers against some of its competition.

As NFTX evolves, its success will depend on a number of factors including improving its market liquidity, expanding integrations among third-party protocols, and out-competing innovating other protocols that release new models of market liquidity. The race for non-fungible liquidity is going to grow significantly from here on out.

Curated Content

Benedict Evans’ Yearly Presentation

Mirror, mirror on the wall, who’s got the prettiest Dune dashboard of them all?

Seed Club Accelerator Cohort #4 applications are due Dec 20th

The rise of Nil DAO

Bored Ape Yacht Club <> Animoca Brands announced a new play to earn game.

Nike goes metaversal

An airdrop for the AKT stakers.

Twitch Cofounder, Justin Kan is launching a gaming NFT marketplace

If you enjoyed this please share it with friends or on Twitter! Thanks for reading, see you next week (probably).