Livepeer: Unbundling Video Infrastructure

F*ck it, I'll do it LIVE!

There are only two ways to make money in business: One is to bundle; the other is to unbundle.“ - Jim Barksdale

Similarly, there are only two ways to build valuable products in crypto, one is to bundle services, the other is to unbundle services. The greater opportunity for crypto protocols currently lies within unbundling and distributing existing services.

Sponsored By: Messari

This free report is available on Messari as well as a host of other free Quarterly reports like Avalanche and Uniswap. Also, check out the Q4 Analyst Call with CEO and Cofounder of Livepeer, Doug Petkanics.

The Lifeblood of The Internet

Existing tech giants function by bundling services across verticals. For example, Youtube (Google) and Twitch (Amazon) aren’t just content distribution engines. The streaming giants are vertically integrated offering data storage for videos, monetization capabilities for creators, and a host of crucial services for developers. The ability to provide all of these services seamlessly helps ingrain content producers and developers into each platform.

Today, video content is the lifeblood of the internet with Cisco predicting that by 2022, 82% of all internet traffic will be video. The rise of streaming – audio, music, movies, content, etc. – has further increased the demand for robust video processing infrastructure. Video transcoding is one of the key processes for all types of streaming including Fortnite Concerts, Twitch gamers, Youtube Podcasters, and GenZ TikTokers.

Video transcoding is the process of reformatting raw video files into viewable files based on the user’s bandwidth (2G-5G) and device. Video transcoding is essential for streaming video (live or static) and the global video streaming market is growing rapidly with MediaKix reporting that the streaming industry is estimated to reach $124 billion by 2025,” while Grand View Research predicts the industry to reach $184 billion by 2027.

As the market for video streaming expands, new infrastructure building with cryptonetworks presents opportunities to increase scale, reduce costs, and remove points of centralized failure.

A Brief Introduction to Livepeer

Livepeer is a video transcoding network utilized by video service providers and app developers/streaming applications. Video transcoding – the process of reformatting raw video files into viewable files based on the user’s bandwidth and device – is a core internet service utilized by streaming providers and social networks like Youtube and Twitch.

Livepeer reduces the costs of live-streaming services (transcoding, media servers, content delivery) by potentially 10x compared to existing services for individual streamers. Unlike Amazon Web Services (AWS) or other transcoding providers, Livepeer offers transcoding pricing based on usage versus server space.

Livepeer has a few key stakeholders within its network:

Video Miners - Orchestrators and Transcoders

Node operators – termed orchestrators in Livepeer – are responsible for receiving video from broadcasters and returning transcoded results. Orchestrators stake LPT in order to perform services on the Livepeer network. Transcoders are responsible for performing work on the Livepeer network, providing computation capacity to transcode the video files to orchestrators.

Delegators

Delegators – individuals who own LPT tokens and stake their tokens with orchestrators in exchange for a fee and a proportion of minted LPT tokens. Orchestrators with more LPT staked can perform more work on the Livepeer network. Additionally, orchestrators can stake their own capital or choose to accept capital from other delegators (but take a percentage of the fee and staking rewards for their service).

Broadcasters / Applications

Applications – also referred to as the broadcasters – are apps or services that require streaming or the use of live video in their functionality. Broadcasters pay orchestrators for transcoding services.

Livepeer – Macro Overview

Livepeer Network Growth

A core function of the Livepeer network is transcoding video for streaming applications and therefore transcoding network usage is an important metric to track to evaluate the health and growth of the Livepeer protocol.

To date, the Livepeer network has transcoded over 73 million minutes of video, 41% of which came in Q4’21. Throughout 2021, Livepeer’s network usage achieved all-time highs in each subsequent quarter, experiencing the most significant growth in Q2 with ~170% in network usage growth.

Throughout Q4’21, Livepeer processed a record ~30 million minutes of transcoded videos, a 37% increase from its previous quarter which was also an all-time high.

Livepeer’s increased adoption aligns with the accelerated growth of video apps utilizing the network, such as Korkuma (enables live shopping videos for companies) and PlayDJ (DJ streaming service). Gaming also remains a core vertical with Livepeer.com – the hosted service built on top of the public Livepeer protocol – partnering with Vimm, a streaming platform for gamers and creators powered by the Hive blockchain. While Livepeer powers a variety of use cases, the majority of usage comes from user-generated content applications (i.e. gaming, music, streaming), but includes popular verticals such as sports, media, and events.

Video NFTs and Computational Service Growth

To date, most NFTs that incorporate video have experimented with relatively short (1-15 second) time lengths. However, the potential for video NFTs – pre-recorded and live – in the minutes to hours presents new types of content and monetization opportunities for creators.

Livepeer has already started experimenting with video NFTs and is poised to serve a core piece of infrastructure for live video NFTs.

In Nov 2021, in conjunction with Glass Protocol, Livepeer cohosted COLLIDE, a live concert – digital and real-world – that captured and minted live video NFTs. Glass Protocol creates a marketplace for creators to issue video NFTs that have instant liquidity as they are bought and sold. Notably, the COlLIDE concert is the first concert where live video was minted as an NFT.

Video NFTs and the continued growth of UGC applications will likely proliferate into the future amidst the backdrop of the creator economy’s adoption of Web3 primitives (e.g. NFTs). In 2022, Livepeer aims to further increase its protocol usage for 4k video and expand into other potential functions including AI-based smart video, AI-enhanced content moderation, object recognition, song title detection, and video fingerprinting.

Livepeer Network: Video Miners

While the demand side of the Livepeer network is driven by broadcasters – applications requiring streaming – the supply side of the network is run by node operators (orchestrators).

The Livepeer network divides the orchestrator role into two specific parts – staking and transcoding. Staking LPT is required in order to provide transcoding services on the Livepeer network.

Given that not every single video miner wants to also operate an orchestrator, video miners can choose to allocate their computational resources to a specific orchestrator pool (private or public). These pools – public and private – compete to perform transcoding work with private video miner pools being selective of the miners that join.

It’s worth noting that the mining process for video transcoding differs from that of Bitcoin or PoW mining. With GPUs, the transcoding processing is handled by a specific chip on a video card and therefore doesn’t demand the same energy requirements compared to an ASIC miner (used for Bitcoin / Ethereum mining). As a result, GPUs can allocate transcoding services to Livepeer while simultaneously playing video games or performing other activities.

Public mining pools – like Livepool – that enable anyone to connect their GPU video cards to transcode video have become widely used. In fact, Livepool currently ranks 8th in terms of orchestrator fee revenue and 11th in total LPT staked.

Network Revenue

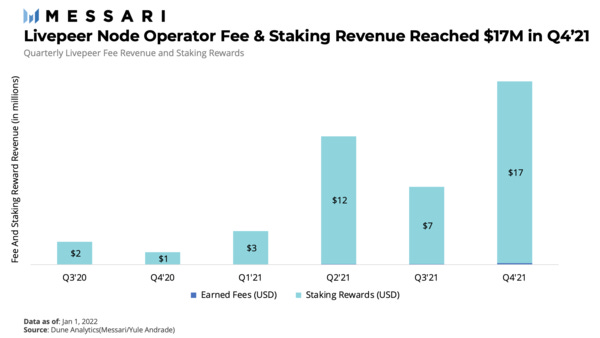

In 2021, Livepeer usage experienced a breakout year with revenue for orchestrators and stakers increasing substantially.

Notably, the entirety of the Livepeer network revenue is directed towards supply-side participants (node operators, transcoders, and delegators). Supply-side revenue in Livepeer consists of network-usage revenue (e.g. fees for transcoding services) and staking rewards.

Staking Reward Revenue

Today, the majority of supply-side revenue comes from staking rewards, with orchestrators generating $17 million in rewards in Q4 and nearly $40 million in 2021. Note, revenue is calculated by the price of LPT on the day earned and so orchestrators who hold a percentage of LPT rewards have likely produced far greater returns.

Although the net amount of LPT staked – and rewarded – has fallen considerably throughout 2021, the price appreciation of LPT has led to a significant increase in LPT staking rewards in U.S dollar terms.

Network Usage Revenue

Orchestrators are permitted to set their fees for transcoding by the price per pixel, meaning transcoding services can be price for different qualities of video (e.g. 4K contains four times as many pixels as 1080p and can be priced accordingly). Network usage (e.g. transcoding services) revenue – which is paid in ETH – makes up a small portion of orchestrators’ revenue.

Livepeer orchestrator transcoding fee revenue increased significantly throughout 2021, generating $154,000 in Q4, an increase of 113% compared to the previous quarter.

This growth in fee revenue directly corresponds to the growth in usage with the first quarter of the year experiencing the greatest percentage growth in fee revenue. Impressively, each subsequent quarter in 2021 witnessed positive percentage growth in service fee revenue.

Like many Web3 infrastructure protocols, the Livepeer network subsidizes node operators with LPT rewards until fee revenue increases to a sustainable level. This initial subsidization is core to Livepeer’s economic model and enables the protocol to compete with existing transcoding providers like Amazon and Google.

Livepeer Dynamic Rewards

Livepeer utilizes a dynamic mechanism for staking rewards. As long as the network staking participation remains above 50%, inflation reduces by 0.00005% per day until inflation hits zero. If at any point the participation rate (% of LPT staked) drops below 50%, then staking rewards increase. Ideally, as the Livepeer network grows, LPT will become deflationary as network participants try to acquire it in order to provide transcoding and computational services on the network.

In June 2021, the percentage of LPT staked began to reach an equilibrium, fluctuating around the 50% threshold.

As a result, Livepeer staking rewards were deflationary throughout 2021 with the exception of the fourth quarter which experienced a 7% increase in staking rewards compared to Q3’21.

Since fee revenue doesn’t generate enough cash flows, it’s likely that orchestrators either raise capital from outside sources to subsidize operations or sell a percentage of their LPT rewards to maintain operations. Notably, there is also a seven-day unbonding period for LPT staking which, while a useful disincentive mechanism, creates capital inefficiency for orchestrators, transcoders, and delegators. However, liquid staking protocols for Web3 infrastructure tokens like Tenderize – set to launch in Q1’22 – will potentially increase liquidity for staked LPT.

Livepeer Governance & Notable Events

Fundraising and Capital Expenditure

Livepeer announced its $20 million Series B funding round in July 2021 with the intention to scale its video streaming platform, expand its technical capabilities, and support more blockchain networks. Subsequently, in Jan 2022, Livepeer announced a $20 million Series B Extension round to expand functionality for broadcasters, ramping up demand generation amongst video developers.

MistServer Acquisition

In Oct 2021, Livepeer Inc. made its first acquisition: MistServer, a media toolkit that helps developers set up streaming servers. This acquisition was fairly strategic considering that Livepeer has been using the MistServer for several years and was the largest user of MistServer (most instances running around the world) prior to its acquisition. More specifically, MistServer performs another key service in the live streaming process – transmuxing.

It’s easiest to view transmuxing as the inverse of transcoding. So, where transcoding takes data and processes it into a different type of encoding, transmuxing, conversely, takes data and repackages it (without changing the content) so that it can be passed onto a different point.

Livepeer has utilized MistServer to build Livepeer.com, the hosted transcoding service run by the Livepeer team. Additionally, Livepeer.com leverages MistServer to take in streams in formats that can’t be directly input into the public Livepeer network, sets the streams up for transcoding, and forwards that output to Youtube.

Governance & Protocol Improvements

LIP 73 & LIP 74: Confluence Upgrade

Since Livepeer staking smart contracts are built on Ethereum, Livepeer has suffered from rising gas costs. More specifically, broadcasters have to pay high transaction fees to pay for transcoding services. Similarly, orchestrators and delegators pay high fees to receive their fees and staking rewards. This makes it less economical for smaller video miners (orchestrators or transcoders) and delegators to participate in the network.

To help resolve these issues, the Livepeer team proposed the Confluence upgrade which would 1) migrate Livepeer staking contracts to Arbitrum, 2) support multi-delegation, and 3) enable participants to obtain existing staking LPT rewards by bridging reward issues on Ethereum to Arbitrum for collection. Since gas fees on Arbitrum are substantially lower, the Confluence upgrade will also increase profit margins for all network participants and enable a larger number of smaller participants to profitably join the network. The Confluence public testnet was deployed on Jan 13, 2022, and will proceed to launch on Arbitrum – assuming the vote is approved – after the auditing process is completed.

Transcoding Verification Improvements

As part of the Streamflow network upgrade in 2020 – which introduced GPU transcoding to the network – slashing was disabled in favor for real-time statistical verification that could be performed by broadcasters. However, this caused several issues including increased latency for streams – since there was a delay to verify before using the transcoded video – and increased the computation burden for broadcasters to verify the transcodings. This year, the Livepeer team proposed and subsequently enabled fast and full verifications which allowed broadcasters to receive and verify video segments in near real-time. The Livepeer team achieved this by enabling broadcasters to insert video into their streams faster while creating an offline dispute resolution process that imposed significant economic penalties – slashing or freezing the ability to participate in the network – on malicious actors. Further, the proposal aimed to publicly relay to broadcasters when a video miner acted maliciously, thereby hurting that miner’s public reputation.

Final Thoughts

With only a select number of companies capable of delivering live video transcoding at scale (i.e. Google, Amazon, Microsoft), Livepeer offers a unique solution – based on cryptoeconomic primitives – to compete with these existing giants. In 2021, Livepeer’s network started to demonstrate strong signs of growth across network usage and supply-side revenue. As the Livepeer network matures and shifts to Layer-2 scaling solutions, the promise of allocating GPU bandwidth for video transcoding becomes enticing for newer individual miners and larger, non-crypto native players.

Livepeer’s Q4 acquisition of MistServer was arguably its most important advancement in 2021, since the integration will ensure that Livepeer can support video ingestion, content delivery, storage, and serve as the foundation for end-to-end live streaming infrastructure. Combined with the network’s upcoming migration to the Arbitrum network – which will reduce costs for existing video miners and enable more video miners to join the network – Livepeer is poised for an eventful 2022.

Currently, Web3 is in its infrastructure phase – unbundling every existing service – until such services become robust enough that they can be aggregated (read bundled) into a unified platform. But that’s a discussion for a later date.

Curated Content

Coinbase Ventures is writing checks - 150 deals, averaging a new deal every 2.5 days. Hot damn.

Remember, not everyone in this industry has good intentions.

Syndicate finally launched, investment clubs are growing.

The bull case for L2s.

Short the regulators.

See you next week, probably.