Integrated Real World Applications

Rialo: the vertically integrated blockchain

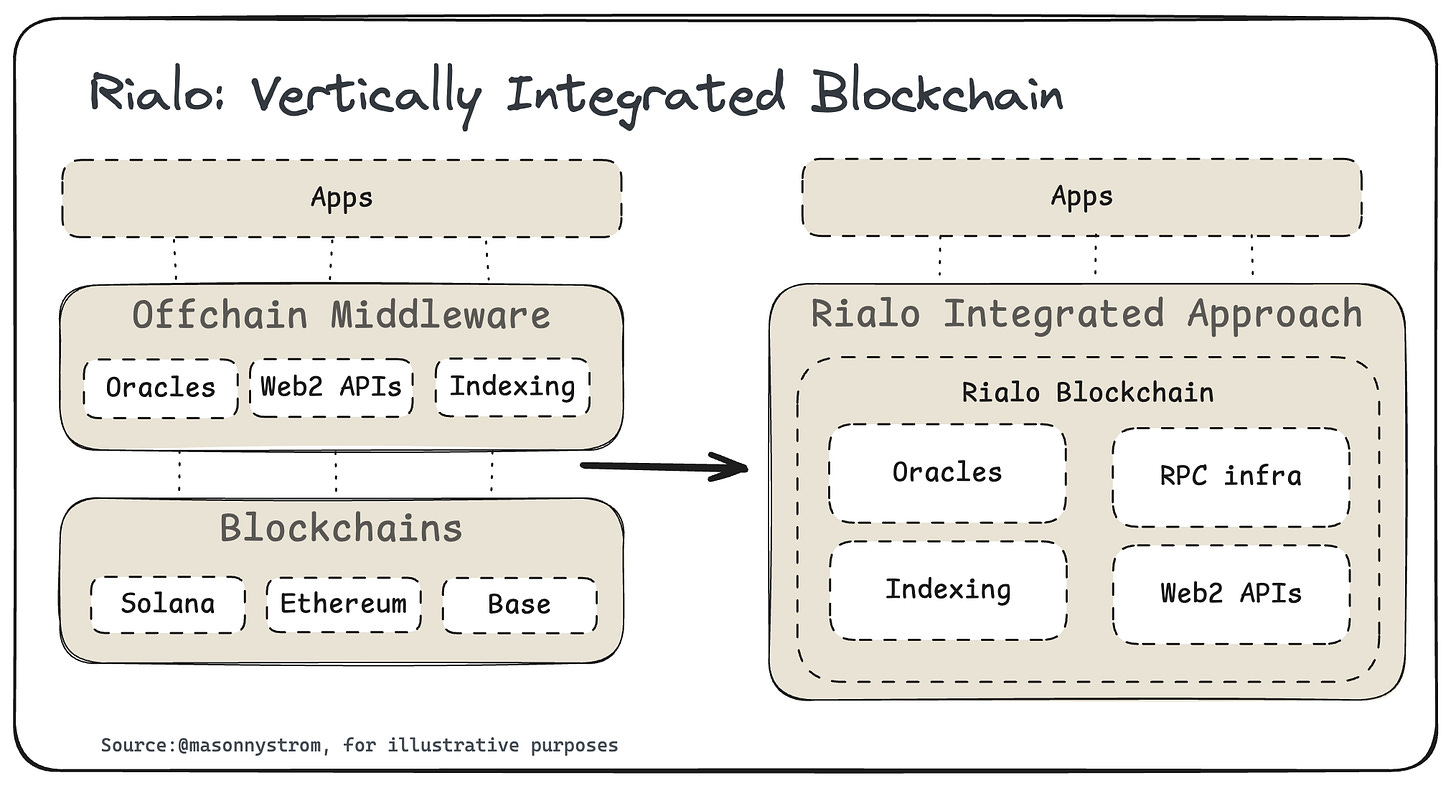

As crypto moves towards a world of real-world applications, interacting with offchain, real world data is critical. As a result, applications today are cobbled together by external middleware that connect blockchains and offchain services (i.e. oracles, RPC nodes, indexers, etc).

Smart contracts can’t see outside data, which is why devs have to pay to ingest offchain data. More importantly, smart contracts, while powerful, aren’t able to write or read to APIs which limits some of their functionality.

Rialo reimagines the approach by building a vertically integrated full-stack solution that can natively access web2 APIs.

But why does vertical integration of offchain middleware and the native access to web2 APIs matter?

Integrating offchain middleware into the blockchain layer provides two core benefits:

Reduces the tax on developers from a UX and cost perspective

Expands the market of applications that can be built on top of blockchains

Vertical Integration of Offchain Middleware: Better For Builders

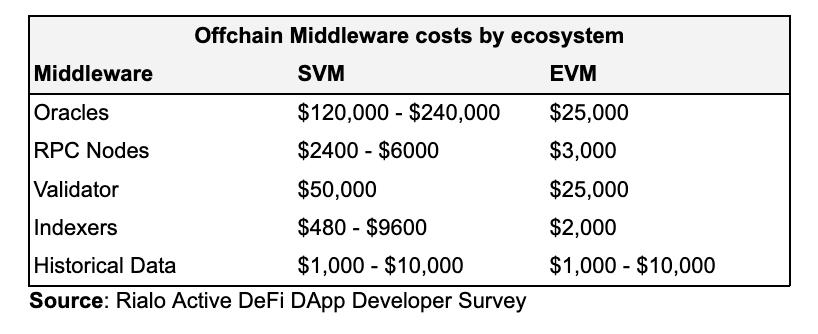

For any application built on blockchains, paying just two offchain middleware vendors can destroy a significant percentage of an app’s margin. This directly makes it harder for developers to build and pushes costs upstream to users.

Each hop down this stack extracts its own margin for its service. Modern applications depend on a variety of services – oracles, indexers, schedulers, bridges, relayers, block builders – each with its own uptime target, incentive model, and rent. These service providers are the new normal for developers and aren’t going away, but they can get cheaper and easier to integrate into applications.

If we look at the established middleware products we can see how extractive this squeeze is. To take an example, for an onchain lending protocol, the additional cost of recurrent liquidation checks are:

300% extra for scheduling

200% extra for the data

$4k/month for indexing for fast results

That is to say, if the protocol charges $1 for gas, the app pays an additional $6 for offchain service provision. This is before even carrying out the liquidation! Lenders like Aave pay around 5% of the loan to liquidation service providers. Keeping to Aave as an example, the mean loan is ≈ $100 k ( $9B total borrows / 90k monthly borrowers) and so a 5 % liquidation cost adds an additional ~$5,000 per liquidation.

It isn’t always this expensive, some of these functions are periodically offered by newer, less mature service providers who subsidize costs to gain market share. But this is only a temporary effect: we don’t pretend that Uber or Doordash will always cost $5 just because they price that way when they launch in a new city.

When functions like scheduling and native web‑calls are bundled directly into the base protocol — Rialo’s approach — the stacked middleware mark‑ups disappear and the developer experience improves.

Expanding the Universe of Integrated Applications

As blockspace continues to commoditize, the differentiators become less about performance (TPS) and more about developer experience, distribution, and application specific capabilities.

While an ideal world is one where all activity happens natively onchain, the real world is messy and bringing more assets and value propositions onchain requires access to third-party APIs and offchain data. Blockchain networks have historically pushed these decisions towards middleware solutions rather than internalizing how their networks interact with offchain data and third-party APIs.

Without a seamless interface to real‑world data and services, even the fastest blockchains will leave apps feeling disconnected and higher friction for users.

With Rialo’s integrated approach, a new class of applications becomes both possible and seamless to implement:

Onchain apps based on web2 API data: Apps with Zapper-like triggers (e.g. email action to transaction) that combine offchain data sources with onchain actions.

AI orchestration: AI agents that can transact efficiently with better indexing and access real-time information

DeFi oracle integrated apps: Oracle integrated you can make liquidation logic programmable at the app level. No need for the liquidation bot tax

Enterprise-grade automations: enable transactions triggered by CRM or email events.

RWA-enabled applications: apps that leverage real-time data from traditional financial markets (e.g. interest rates,

Blockchains with embedded social data: Web2 API integrations that unlock social data for next-gen crypto applications.

Investing in Rialo: The Vertically Integrated Blockchain

At Pantera, we’re excited to lead the $20 million funding round for Subzero Labs as they build Rialo. The Rialo team is especially situated to build an application specific blockchain. Cofounders Ade Adepoju and Lu Zhang were both early engineers at Mysten Labs who contributed to the Sui network. Beyond helping build Sui, Zhang built Diem, Meta’s crypto initiative, and large-scale AI/ML infrastructure at Meta and Google. Meanwhile, Adepoju developed distributed systems at Netflix and advanced microchips at AMD.

With years of deep involvement in multiple layer-1 protocols and decentralized applications, Adepoju and Zhang have arrived at a vertically integrated approach that abstracts middleware and lays the foundation for new types of real world applications.

Special thanks to Matt Stephenson and Lauren Stephanian for comments and insights in this essay.