Examining The DeFi Ecosystem And Its Existing User Base

Breaking down the takeaways from Alethio's DeFi Report and Consensys DeFi User Research Report.

Hey Web3ers! This week Ethereum data analytics firm, Alethio came out with a Q1 Report for DeFi. Additionally, ConsenSys released a DeFi User Research Report that Georgia Rakusen and I co-authored. They are rather lengthy ( I know, partially my fault) So, as an act of penance for writing such a long report, I thought I’d just break down the takeaways for you.

If you're new to crypto or just aren’t very familiar with DeFi then check out this guide for beginners. Otherwise, let’s get to it.

ConsenSys DeFi User Research Report

ConsenSys user research team conducted random interviews with DeFi users in order to assess to main objectives:

Understand the world of current retail defi users (their behaviors, needs, pains and goals, how they choose between products, and what can improve their experience)

Deliver recommendations for companies and individuals building DeFi products and services

The study screened and selected individuals based on a number of criteria and then conducted lengthy interviews in which they tried to ascertain answers to the stated objectives.

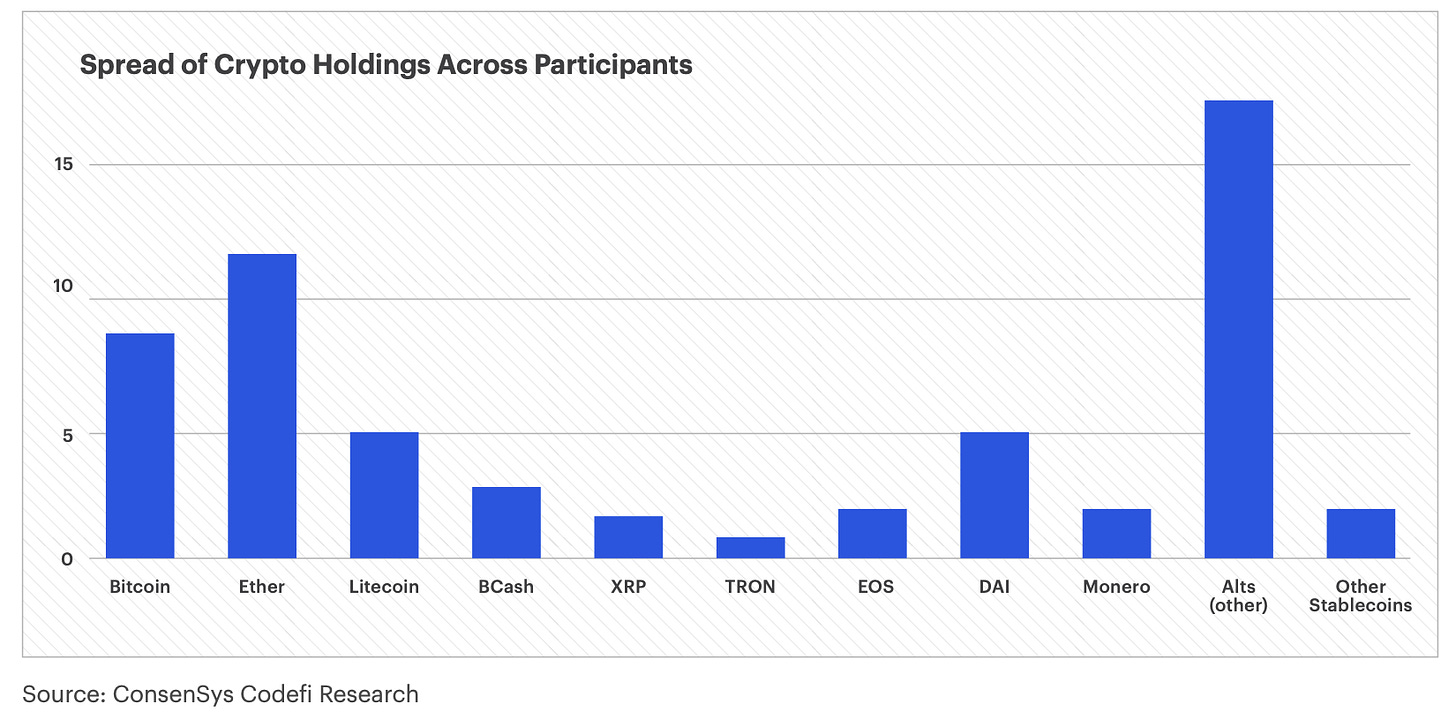

To answer the first question on all of your minds – here are the cryptoassets these individuals reported that they own.

Honestly, the biggest takeaway from this chart is that many individuals are mostly enticed by the potential to make money (Gasp!). Also, clearly the average crypto user doesn’t know how to value these assets. If they did, they probably wouldn’t be invested in Litecoin, BitcoinCash, XRP, or various altcoins. These assets all have widely known issues from a lack of developer community (LTC) to a centralized entity manipulating the supply (XRP).

NOTE: Please do your own research before investing in any cryptoassets.

Takeaway 1: DeFi User Pain Points

The report also identifies the major pain points of current DeFi users. Some of the pain points identified were:

Constantly a new protocol to check out

Keeping on top of price volatility

Keeping on top of the best earning/borrowing rates

Fees associated with moving my coins around

Onramp; I have to move my coins several times to even earn interest

As a DeFi user myself, I wholeheartedly agree that keeping up with price volatility can be a major point of frustration/stress. Ensuring that your Maker Vault stays over collateralized can be a point of stress. On one hand, you could just over collateralized your Vault to like 300%, but on the other hand the lower the collateral ratio you have, the more dai you can put into lending protocols like Compound.

Moreover, the rate of innovation in crypto is truly astounding. Staying up to date on the newest synthetic assets or derivatives of Dai can be incredibly challenging for those who don’t spend hours a week thinking about crypto or reading crypto Twitter – it’s only a problem if I can’t stop…

Pushing Back on the Pain Points

While many of the users reported fees and finding the best earning/borrowing rate as a pain point, I’d like to push back on that claim. Anecdotally, the DeFi users I have seen in the crypto ecosystem tend to be much more financially literate and either possess backgrounds in finance or prior personal experience investing. I’d wager that most individuals will not shop around for the protocol with the greatest rate of return or the lowest fees. Consumers will sacrifice the few basis points in exchange for trust and convenience. Coinbase is a perfect example of this and traditionally charges higher fees than other exchanges like Kraken or Binance. But, Coinbase is still the easiest place to purchase crypto and has one of the best reputations in crypto.

The preferences of early crypto adopters may not reflect the demands of mainstream consumers. To further highlight this point, some of the participants in the study stated that decentralization and privacy weren’t the most important features.

“While all the participants had a desire to invest and realize speculative gains, not all participants showed a strong preference for decentralization or privacy. Some users identified that it was of importance, but didn’t state that the level of decentralization or privacy altered their decision making processes or choice in DeFi applications. ”

While the early crypto adopters deeply care about privacy and decentralization, the average DeFi user may favor a middle-ground solution that prioritizes ease of use.

Takeaway 2: DeFi is Still an Experiment

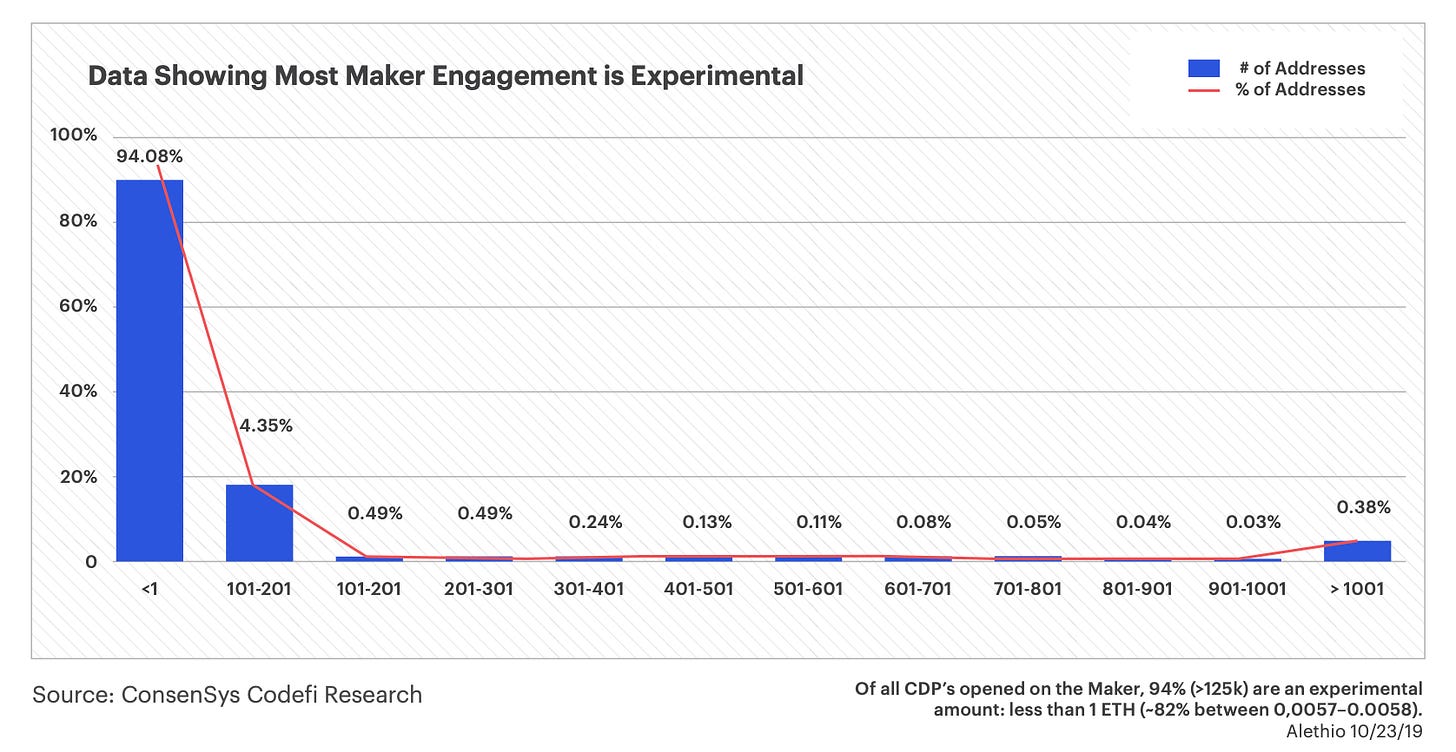

One final takeaway from the User Research Report is that DeFi usage is largely experimental. The reports states that 94% of all Maker Vaults opened in 2019 had less than 1 Ether which shows that most people are experimenting with these protocols rather than actually using these DeFi apps as a saving account. So while the amount of Ether locked in DeFi protocols exceeds hundreds of millions of dollars, it’s important to look at the actual user demand which is still very low.

Alethio DeFi Report Q1

Alethio’s DeFi Report is jam-packed with graphics and stats about the DeFi ecosystem. Over the course of Q1 2020, there were just over 80,000 unique addresses that interacted with an Ethereum DeFi protocol.

Takeaway 1: Visualizing the DeFi Ecosystem

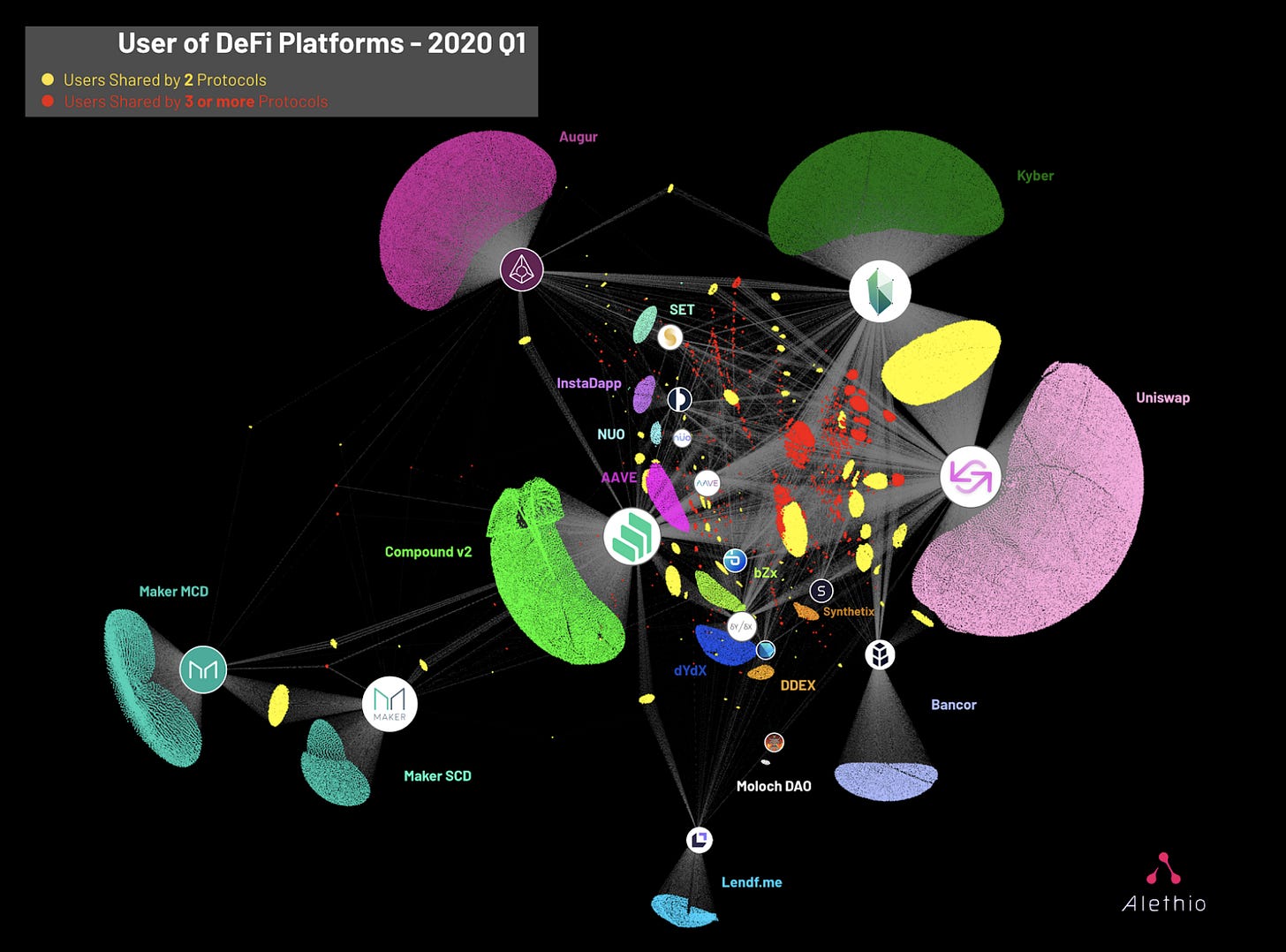

Below is one of my favorite visualizations from Alethio that truly showcases the composability of DeFi protocols. Each individual dot represents an Ethereum address interacting with a specific protocol. More interestingly, the yellow and red dots show the relationship between Ethereum addresses that are interacting with multiple protocols.

Kyber and Uniswap (10,955 users) clearly have the strongest relationship between users of two protocols. Also of note is the dual relationship Compound and Uniswap have with DeFi users.

The strongest relationship between red dots appears to be Kyber, AAVE, and Uniswap. This is interesting for a few reasons. First, AAVE is a relatively new protocol that has gained traction because of its flash loan product which enables an individual to borrow money and repay it back in the same transaction.

One final point of interest from the above graph – there appears to be a small number of individuals that are using Maker Vaults and Compound, which means that Compound is getting more users who are simply purchasing (via Uniswap or Kyber) and depositing Dai rather than creating it (via Maker) and depositing it.

Takeaway 2:Examining the DeFi Super Users

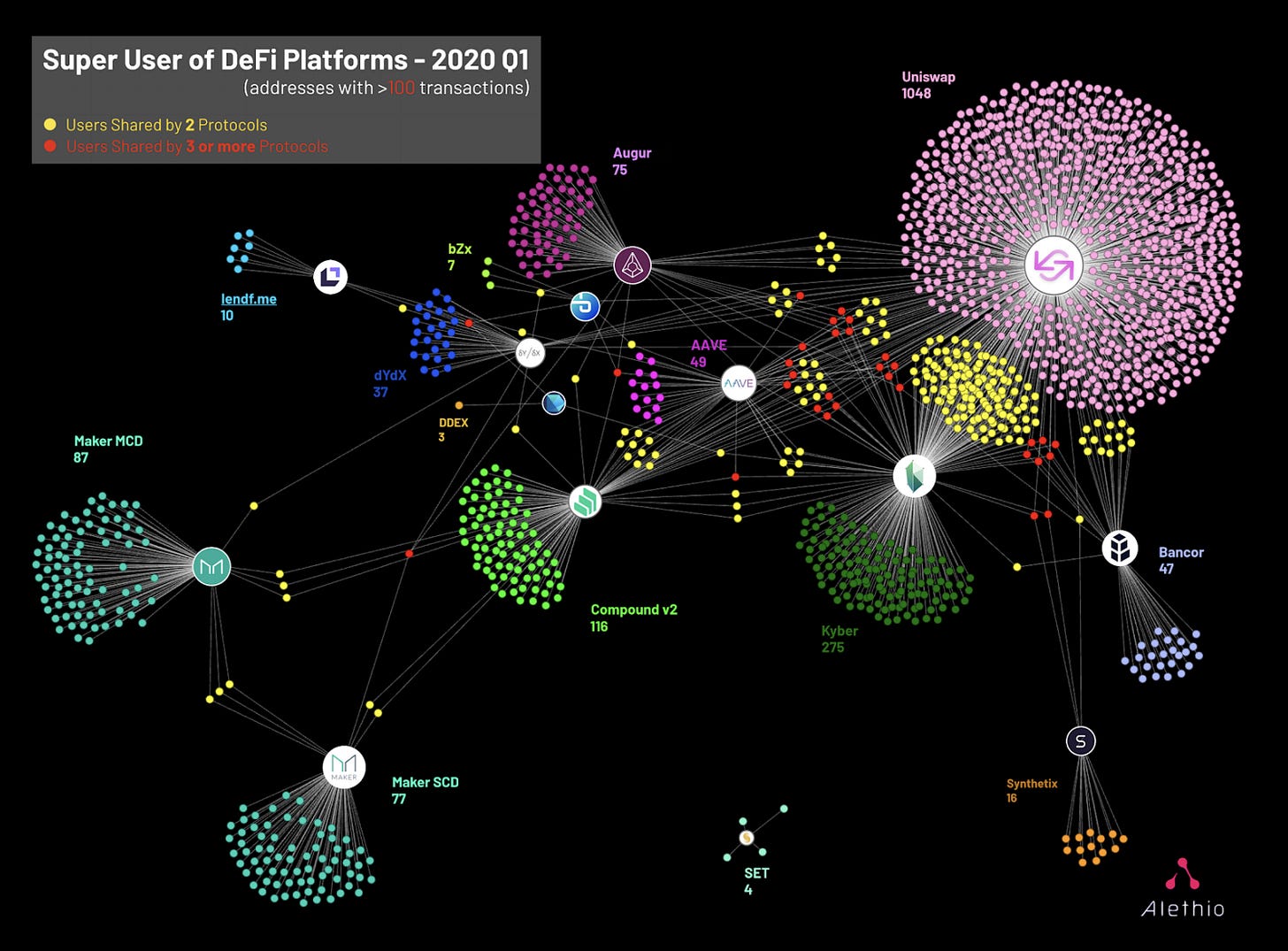

Alethio broke down the DeFi user ecosystem even further to display “Super Users” – individuals who completed over 100 transactions over the course of the past three months. Alethio’s report identifies 1,585 super users, most of whom are utilizing trading protocols like Uniswap (1048 users) and Kyber(276 users).

That leaves 261 Super Users which appear to be mostly utilizing protocols like Augur, Maker, and Compound. Super Users is a decent metric for protocols that revolve around continuous speculation like trading, synthetic assets, derivatives, and betting. These are events that happen often and therefore require more frequent transactions. This metric will probably be even more useful on a greater timeframe (6 or 12 months).

The Super User metric is obviously less useful for protocols that are designed for less frequent trading. For instance, the average Maker or Compound user probably shouldn’t be transacting every day.

For those who want to learn how to use some of these DeFi protocols, check out DeFiDad’s tutorials!

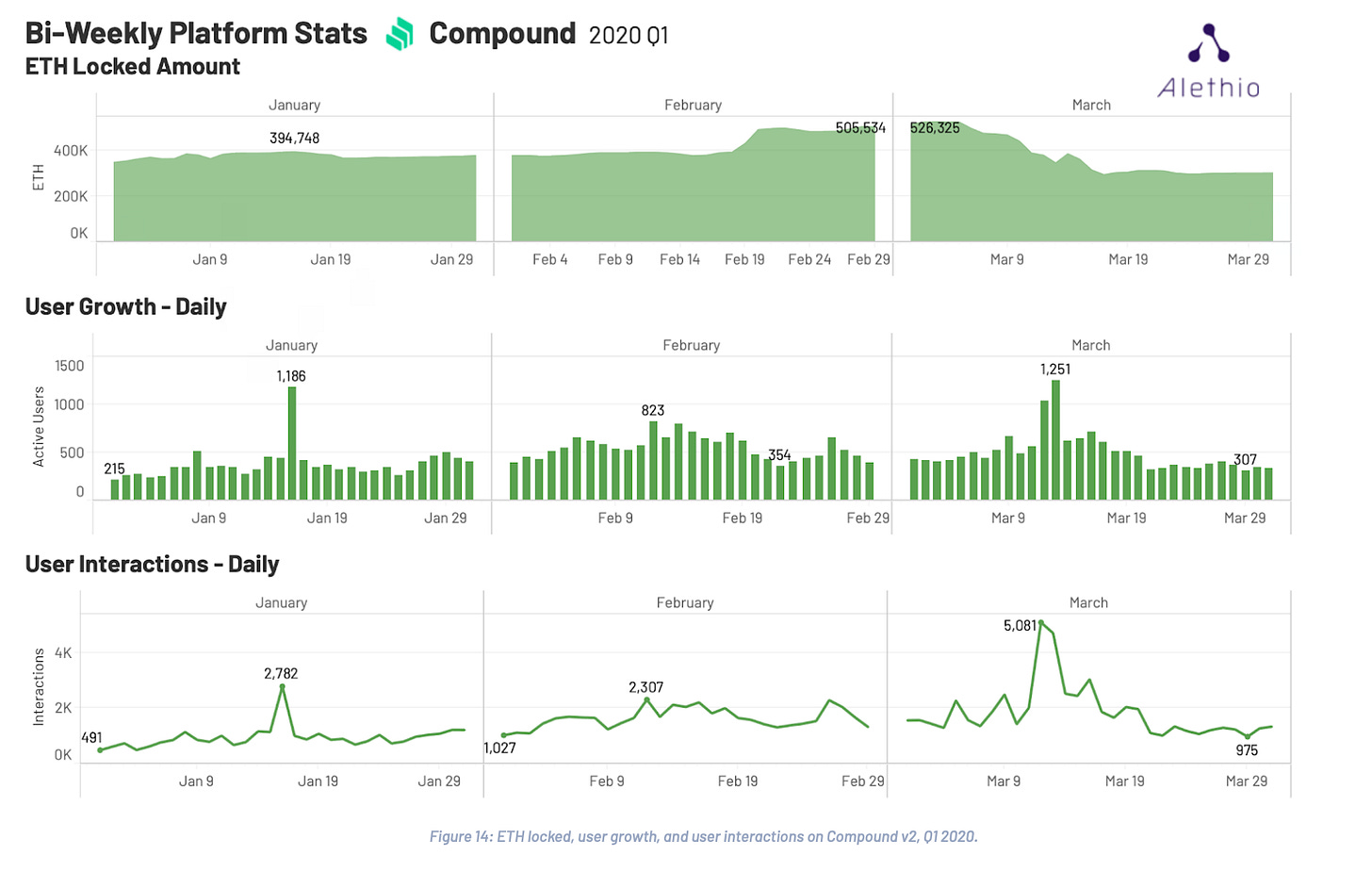

Takeaway 3: The Impact of Black Thursday

Much of Alethio’s report focuses on the aftermath of Black Thursday. Essentially every protocol lost a significant amount of liquidity and user rates fell to around the same levels that they were at last year. Compound experience a significant drop in users and user growth since March 12th.

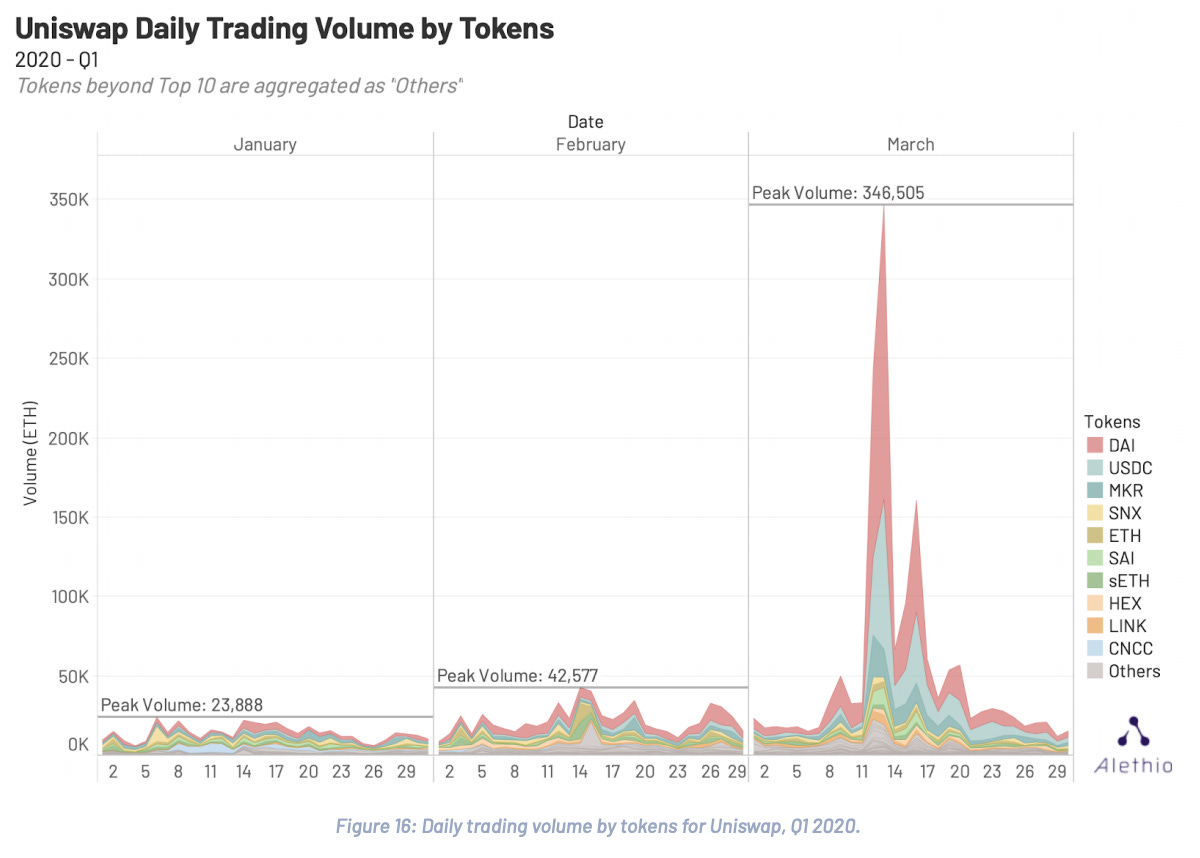

One silver lining is that Uniswap was able to handle a massive uptick in trading volume (over 345k ETH) on March 12th and 13th.

Final Insights From Alethio’s Q1 DeFi Report

Alethio’s Report closes with 3 topics/areas of interest for DeFi in 2020. I’ve provided their 3 points along with my opinion.

ETH locked in DeFi will regain traction.

The amount of Ether locked in DeFi protocols significantly decreased because of the events on March 12th. The Alethio team believes ETH locked in crypto will come back relatively quickly. I’d agree with this outright if our society wasn’t still shut down from a global pandemic. I think a good portion of the original volume may return, but it’s still unclear if an economic drawdown increases the amount of ETH locked in DeFi protocols.

Flash Loans Will Expand.

I completely agree. Flash loans are one of the most interesting mechanisms in crypto to-date. Large loans that required zero-collateral are new and exciting. There will be lots of positive and negative outcomes.

Pay Attention to DeFi Insurance Platforms

I’m of the belief that greater assurance among protocol finances will help attract more users. People aren’t going to put their life savings into Ethereum protocols if they aren’t 100% sure that they will keep their money if something bad happens. Insurance is probably the fastest way to achieve that level of certainty. If my crypto in Compound, Maker, or another protocol was FDIC insured (or crypto equivalent), I’d transfer out of fiat cash tomorrow.

Recommended Reads

100 Little Ideas by Morgan Housel

Bailouts Don’t Save the Economy by Nic Carter

Advancing Web 3.0 is a weekly newsletter about cryptocurrencies, decentralized finance (DeFi), and technologies that are shaping the next era of the Internet. Welcome to the bleeding edge. Welcome to Web 3.

About the Author: I’m Mason Nystrom, a writer and aspiring angel investor. Previously I worked for ConsenSys as a marketer focused on marketing strategy for ConsenSys and its portfolio companies. Prior to joining ConsenSys, I worked as a Business Analyst at Gatecoin, the first cryptocurrency exchange to list ether, Ethereum’s native cryptocurrency.

I’m passionate about Bitcoin, Ethereum, DeFi, Web 3.0, and all things crypto. When I’m not writing or heads down in crypto, I’m learning to become a developer at Lambda School.

The views, information, and opinions expressed are solely those by the author and are meant for informational purposes only and are not intended to serve as a recommendation or investment advice to buy or sell any securities, cryptoassets, or other financial products.