Dollar Supremacy And The Rise of Fiat Stablecoins

Why dollars are still king and fiat stablecoins may see a resurgence.

Hey web3ers! This week we’re going to talk about cold, hard, cash – even though cash is now warm and pretty flimsy. We’ll also discuss the importance of self-sovereign currency and how this pandemic might reignite the desire for digital fiat currencies.

In other news, earlier this week I published a beginner’s guide to DeFi that answers all the questions you probably have about Ethereum’s open financial ecosystem. Feel free to check it out or shoot me the questions that you still have! Also, this is a must-read for the week.

Now, let’s talk about warm-flimsy-papery-and-sometimes-cocaine-laced-$$-dolla-bills,

The Apex Predator of the World: The United States Dollar

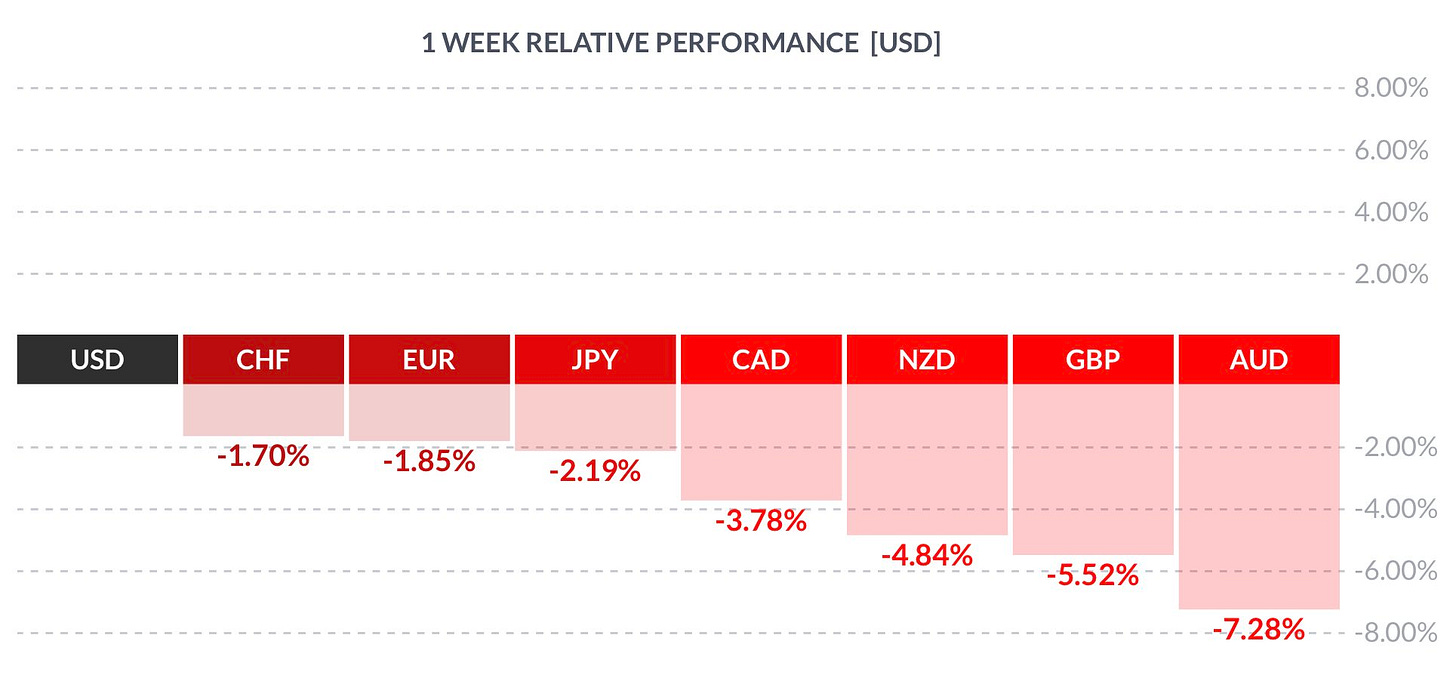

The U.S government just approved a 2 trillion dollar stimulus bill this past Friday, but the U.S dollar isn’t going anywhere, even in the face of potential long term inflation. In fact, the past couple of weeks have only strengthened the U.S. dollar as it continues to prove it’s global supremacy. Looking at the forex data, the first week of quarantine shocked the global system and resulted in a strong sell-off of major foreign currencies compared to the U.S dollar.

Week of March 13th USD dollar performance in relation to other major global fiat currencies.

Image Source: Michael Brown

Why did the dollar perform so well? Global markets are often denominated in U.S dollars, typically because USD is more liquid compared to other currencies. In times of crisis, liquidity becomes even more important. Additionally, companies and financial institutions are comfortable holding U.S. dollar-denominated assets – like U.S treasury bills – on their balance sheets.

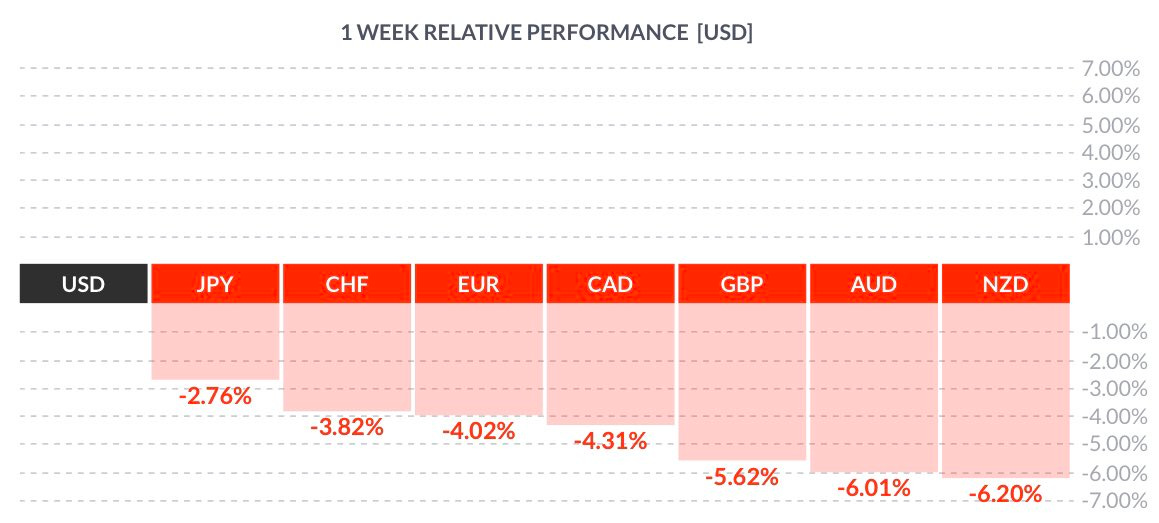

We can see in the image below of the following week (15th-20th), the U.S dollar continued to perform strongly against every major currency. USD performed especially well compared to the British Pound (GBP) which hit a 35 year low versus U.S. dollars. During this week the Bank of England also announced another round of quantitative easing as well as cuts to interest rates.

Week of March 20th USD dollar performance in relation to other major global fiat currencies.

Image Source: Michael Brown

Part of the USD’s strong performance may have been aided by companies that were required to sell local currency-denominated assets in order to pay more national contracts or assets that may be denominated in USD. In the interest of remaining liquid, global companies may choose to sell local currencies or assets that are denominated in weaker national currencies. There are multiple factors that determine currency exchange rates but the important part to remember is that the market is currently volatile.

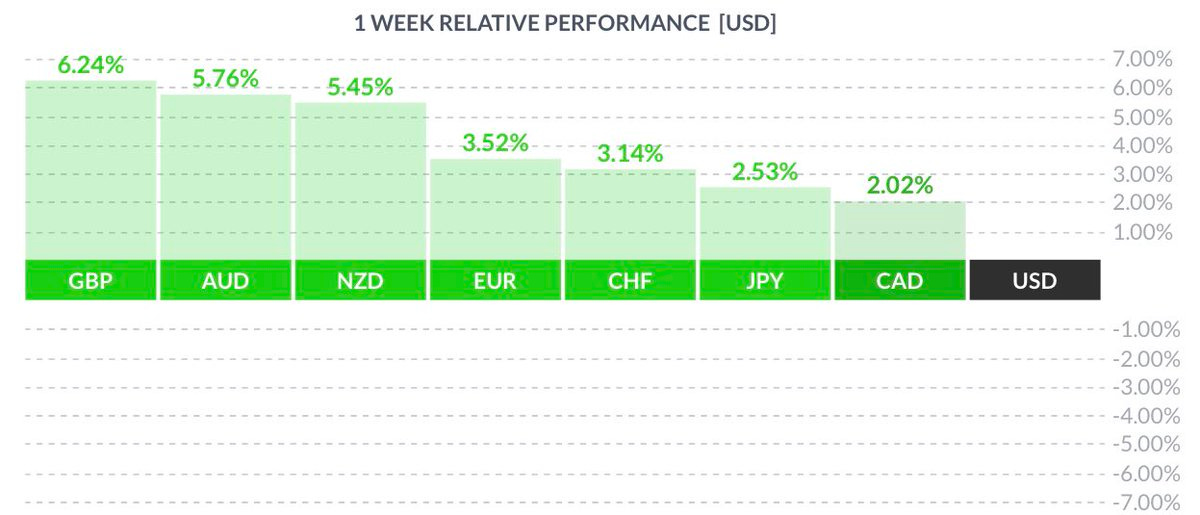

For evidence of this volatility, look to this week which witnessed an opposite reaction as the dollar performed incredibly poor versus national fiat currencies, particularly the Pound and Aussie dollar.

Week of March 27th USD dollar performance in relation to other major global fiat currencies.

Image Source: Michael Brown

I know what you’re thinking – “the dollar doesn’t look very, um, dominant in this chart, Mason”. That’s correct, but this chart shows the unprecedented volatility the currency exchange markets are facing. This month, the Australian Dollar/USD rate experienced weekly drops and gains larger than it did in the entirety of 2019. Currency isn’t supposed to be volatile. It’s supposed to be relatively stable with slight inflation every year.

Here’s where the dollar dominance comes in. Many people are concerned about the U.S government’s massive stimulus package and the potential ramifications for the coming years that those actions will have on the global economy and the strength of the U.S dollar. While these valid concerns (very valid), the government printing more dollars isn’t the greatest determinant of its strength. Rather, the strength of the U.S dollar is determined by the desire – of countries and global organizations – to hold USD. Luckily for the U.S., the dollar is still highly regarded and as such the U.S dollar will likely remain very strong as international corporations take on massive amounts of debt financing that is denominated in U.S dollars.

Image Source: Source: Bank for International Settlements, Ritvik Carvalho, Marc Jones | REUTERS GRAPHICS

With record levels of borrowing, primarily in U.S bonds and USD denominated assets – the dollar isn’t going anywhere. The U.S dollar remains the apex predator of the financial world and will at least for the remainder of this recession which is verging on becoming a depression.

Why is this important? How does this relate to crypto?

I’m glad you asked. Obviously, global macro trends have long term impacts so I just want to highlight a few that I find interesting.

The Resurgence of Creating a Digital Dollar and Central Bank Digital Currencies

Governments and major banks have been quietly looking at creating digital fiat currencies. A digital dollar would undoubtedly make stimulus aid distribution magnitudes easier. Sending citizens money via their phone is faster and provides greater benefits than mailing a check. And, while places like the U.S have direct deposit to bank accounts, most people around are underbanked or unbanked completely which makes receiving any type of aid difficult. A digital fiat currency would help individuals that don’t have a bank account but are able to secure a cell phone.

Additionally, a digital dollar would make controlling the money supply much more efficient. Governments could easily repurchase or issue new currency without the costly expenses of labor and printing.

One implementation of such a digital dollar would be in the form of a Central bank digital currency (CBDC). Central bank digital currencies (CBDC’s) would represent a claim against the central bank, similar to how banknotes function today. This would potentially make regulatory approval less contentious and faster to integrate into the existing financial system. This year, the Bank of England announced that a consortium of banks will examine the potential benefits of a creating a digital currency. You can read more about CBDC’s in Central Banks and the Future of Money, a whitepaper published by ConsenSys.

Rise of Fiat Stablecoins

Stablecoins, whether backed by fiat or by another form of collateral is officially the first killer crypto application. A global crisis helps reinforce how important money is as the mechanism of last resort to quell impacted economies. Back in January, stablecoin transfer volume flipped ether transfer volumes. This was largely a result of USDT migrating to Ethereum but highlights the clear value proposition of stablecoins on a permissionless blockchain.

Notably, Black Thursday (March 12th) resulted in Maker adding Coinbase’s stablecoin to the protocol’s collateral base which will further grow the adoption of fiat-backed stablecoins. Moreover, fiat stablecoins have performed well in the past month as crypto investors purchased stablecoins to mitigate their losses in more volatile assets like BTC and ETH.

While a fiat-backed stablecoin is less exciting than a full self-sovereign stablecoin, they’ll also be less volatile until Ethereum or another permissionless blockchain grows large enough (hundreds of billions in collateral, if not more).

Opting out of the Financial System

The people most affected will be in countries that do not possess incredibly resilient financial systems held up by global superpowers. Global demand is increasing for more stable currencies like the USD, Euro, Japanese Yen, and Swiss Fran. Weaker countries are going to experience inflation of their local currencies and an increasing lack of economic stability. This global event might shift some nations to purchase store of value assets like gold and bitcoin out of financial risk mitigation.

More importantly, the coming corporate bailouts and lack of government support might convince people around the world the importance of a sovereign financial system. When people feel disenfranchised by the system they live in, they try to opt-out. This time, Ethereum and Bitcoin present an opt-out mechanism.

Cryptocurrencies and permissionless blockchain networks are a social and political movement. Yes, there are financial and economic attributes, but deep down it’s a revolution. Revolutions are won by the people who fight them, not solely by the financing.

Until next week,

Mason

Advancing Web 3.0 is a weekly newsletter about cryptocurrencies, decentralized finance (DeFi), and technologies that are shaping the next era of the Internet. Welcome to the bleeding edge. Welcome to Web 3.

About the Author: I’m Mason Nystrom, a writer and aspiring angel investor. Previously I worked for ConsenSys as a marketer focused on marketing strategy for ConsenSys and its portfolio companies. Prior to joining ConsenSys, I worked as a Business Analyst at Gatecoin, the first cryptocurrency exchange to list ether, Ethereum’s native cryptocurrency.

I’m passionate about Bitcoin, Ethereum, DeFi, Web 3.0, and all things crypto. When I’m not writing or heads down in crypto, I’m learning to become a developer at Lambda School.

The views, information, and opinions expressed are solely those by the author and are meant for informational purposes only and are not intended to serve as a recommendation or investment advice to buy or sell any securities, cryptoassets, or other financial products.